Fine Wine Investment Report 2020 and a look ahead at 2021

by Juliette Martin

2021-03-04

Miles Davis, March 2021

In early December I wrote the following:

‘Traditional assets continue to bounce around, no doubt causing palpitations and stress. More than ever, this year has been about timing in the capital markets, and if you got that wrong, the chances are you got it expensively wrong. Not so for vino! Unlike after the global financial crisis, the wine market has held its nerve, merchants did not mark down prices and the market has been stable. Investors are about, and even Bordeaux prices feel like they are firming up. Collectible assets are in vogue and it is easy to see why given these circumstances.’

Not too much has changed since then although there has been plenty more talk about inflation, with the UK’s November numbers coming through much higher than anticipated. This can be viewed as a positive. There has also been the small matter of a new American President. This, in itself, should not have a direct influence on the wine market (!?) but a $1.9 trillion stimulus package and a clear signal that money is going to keep being pumped into the system might be!

So, the macro factors are looking stable and the index performances from last year are also looking sensible. There is no massive ‘feel good factor’ about, which often brings about a more boom-and-bust style dynamic, so this is beginning to feel like an old-fashioned wine market, steady as she goes, nice little earner, thanks very much.

Bordeaux First Growths continue to be the fly in the ointment, underperforming all the other regions with +2.8%, save California with -2%, and generally Bordeaux’s market share continues to slide and is now less than 40% (95% ten years ago!). Pricing from a few of the Chateaux meant the 2019 en primeur campaign awoke the old beast for a moment but otherwise, the top end wine market of Bordeaux continues to struggle. Interestingly, the much broader Bordeaux 750 fared far better with a nearly 10% rise.

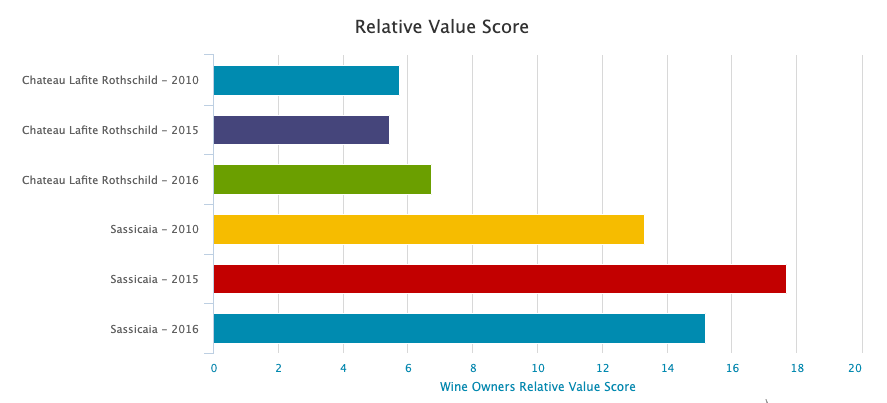

Italy was the star of the wine market show in 2020, with Tuscany posting nearly 20% gains and Piedmont 6.4%, followed by Champagne with 12.7%. It is more than coincidence that these markets have been exempt from US tariffs in recent times. Italy has long lived in the shadows of France in terms of reputation and price in the fine wine world, but the gap is still vast, certainly pricewise. The super recognizable names of the Super Tuscans, which have recently benefited from the mega vintages of ’15 and ’16, consistently receive incredibly high scores.

The 2016 Sassicaia (100 points WA, 97 VM), one of the most expensive Sassicaias of all time, is £230 a bottle, Lafite Rothschild 2016 (99 WA, 97 VM) is £530 a bottle, and production levels are roughly twice as much at Lafite. Maybe this is not a fair comparison but given the price differential and the tariffs in place, I know which one I would be backing:

This is a short excerpt from Miles Davis' 'Wine Owners 2020 Wine Investment Report and a look ahead at 2021'. CLICK HERE to read the full report.

Posted in:

Fine wine analysis,

Tags: