January market report

by demetraWO#11:00:41:817

2014-02-06

Average cellar size £60,000

Total cellars under management £40m

|

January |

Overall |

| Bordeaux |

26% of total trades |

39% |

| Tuscany |

23% |

12% |

| Rhone |

21% |

13% |

| Burgundy |

21% |

17% |

Enthusiastic reviews from Antonio Galloni seem to have piqued interest in the 2010 vintage in Tuscany and Piedmont, with back vintages in Tuscany hanging on the coat-tails of the 2010. The tried and tested Supertuscans seem to be the big winners, with trading users offering and bidding around Sassicaia, Ornellaia and Masseto in mid January, with a high correlation of offers to trades across the region.

The inclusion of some excellent new private collections of Rhone and Burgundy in December and January have pushed up the market share of those regions to rival Bordeaux in those months, with a spread of private and trade buyers picking up top wines from producers like Guigal, including a rare parcel of 1989 la Turque trading at £2,900.

Bordeaux, even in a relatively flat market for the region, continued to account for the largest percentage of Exchange trades in January. Interest focusses around classic wines such as 1982 Latour (recent trades at £13,300), top scorers, and ‘off’ vintages, particularly among the first growths. On the right bank in particular, 2005 appears to be attracting new interest where the price is right, so perhaps the prospect of an uninspiring En Primeur season is already encouraging sparks of interest in great vintages with a track record of quality and performance.

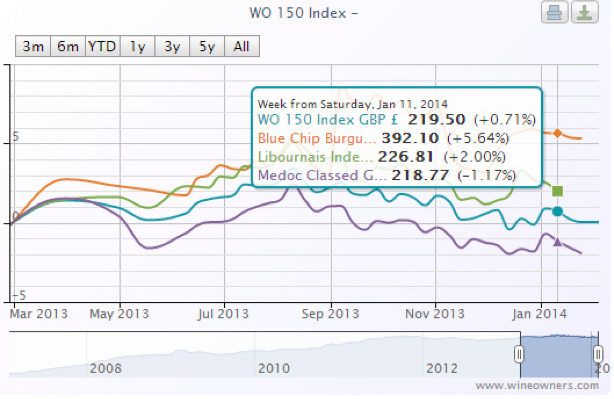

Index comparisons show a relatively flat year’s market, with Medoc Classed Growths slightly underperforming, and top level Burgundy slightly bucking the trend by showing 5.6% growth compared to a base value at Feb 2013.

Posted in:

Fine wine analysis, Fine wine trading, Market news and analysis,

Tags:

Bordeaux, Burgundy, fine wine analysis, fine wine exchange, Medoc Classed Growths, Piedmont, Tuscany, Wine,

Value, track and trade fine wine

Sign up for a free Wine Owners account or go premium. No commitment. No credit card required. View all subscription plans.