by Wine Owners

Posted on 2019-01-24

Haut Brion has always been referred to the connoisseur’s choice amongst the upper echelon and indeed it averages the highest scores across multiple vintages within its peer group. Yet strangely, and more often than not, it trades at a discount to its peers.

Looking at this Relative Value Score the 2006 (£3,500 per 12) stands out but good investment rationale can be argued for the ’90, ’95, ’96, and ’01 also.

The case for the ’90 (£8,900) is that it is currently trading at its widest ever discount to its chart-topping sibling of ’89 (£25,000) and the scarcity force is strong!

1995 (£4,300) because it’s getting on a bit now, is not that challenging in price terms and is drinking very nicely, as personally witnessed at Thanksgiving.

Last week the ’96 (£4,200), in my view a better wine than the ‘95, gave an effortless history lesson in classicism and has a long and charming life ahead. It was allowed five hours in the decanter which was richly rewarded and is a stupendous wine albeit not so overtly fruit driven as Mouton ’96, but that wine is £1,000 more per case at a similar rating level.

The ’01 is £3,700, so very low for a first growth and has been drinking well for some time. Its relative value score above 8 makes it look interesting.

The giants of ’05, ’09 and ’10 are exactly that and deserve to trade in another price bracket altogether. This commentator’s view, however, is that’s where they will stay for the time being and price performance in the short to medium term will evade them, as it has done in recent times:

Buy: Haut Brion ’90, ’95, ’96, ’01 and ‘06

Sell: Haut Brion ’05, ’09 and ‘10

Haut Brion 2000 will be included in a separate post.

by Wine Owners

Posted on 2019-01-23

WO Score: 96

Price: £3,500 per 12

Haut Brion 2006 is cheap, working relatively on a vertical basis by comparing it to other similarly rated vintages of Haut Brion and also on a horizontal basis, comparing it to its first growth peers. Its absolute relative score of very close to 10 is a leading indicator - anything in double figures for a first growth positively screams a buy. This falls marginally short of that magical figure but its consistent notes and firm scoring of 96 gives it a buy recommendation.

by Wine Owners

Posted on 2019-01-21

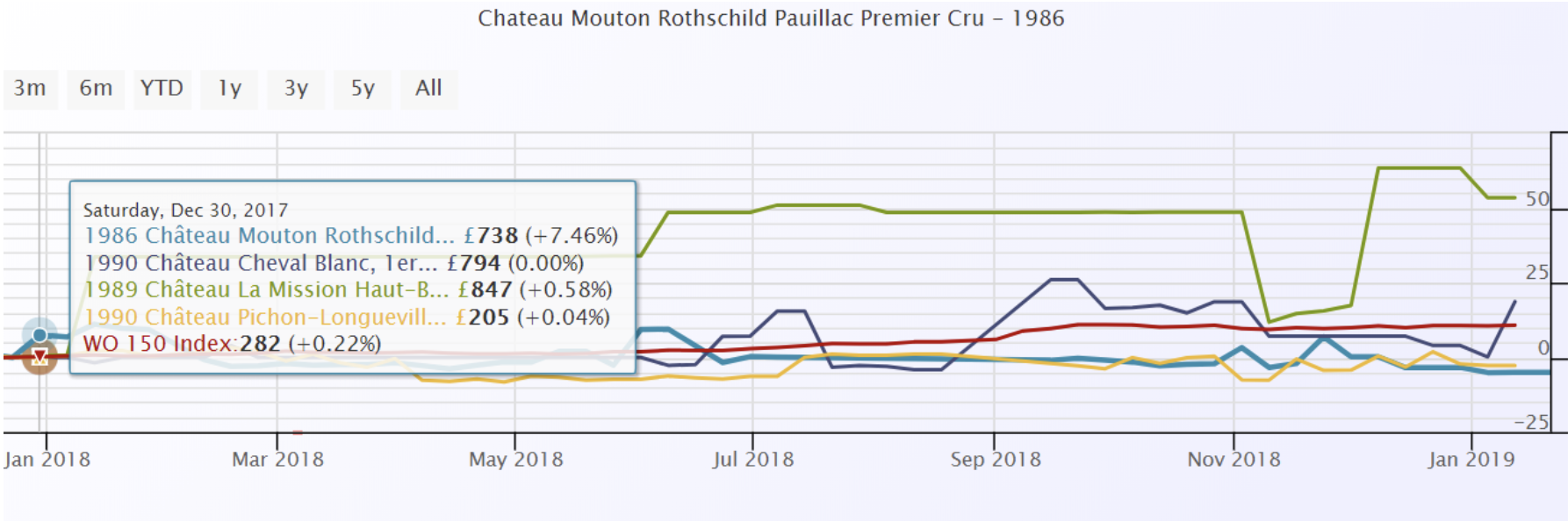

Latour ’82, Mouton Rothschild ’82, Mouton Rothschild ’82, ’86, Haut Brion ’89, La Mission Haut Brion ’89, Margaux ’90, Cheval Blanc ’90 and Pichon Baron ‘90

When managing two wine investment funds (2006-2016) we referred to this subsection of the portfolio as ‘the legends‘. They all received cast iron reviews from all the major critics and rock solid and multiple 100s from Big Bob. Cheval Blanc ’90 “unequivocally a brilliant wine” (Neal Martin) has slipped a little to a 98+, but otherwise these wines are confirmed as truly great – legendary in fact! As such, they don’t come cheap (prices in GBP per bottle in graphic below).

Latour and Mouton ’82, +46% and 38% in 2018 respectively, Haut Brion and La Mission ’89 +35% and +52% respectively and Margaux ’90 +35% have all broken out and have massively outperformed the index in the last few months. I believe they can continue to yield positive returns.

Scarcity has been the big driver of price rises in the last couple of years as demonstrated most ably by Burgundy (WO Burgundy Index +33% for 2018, +16% in 2017). This is a prime example of how the principle of good demand versus limited supply in the wine market can work. As a region Burgundy has thrashed others as production is so much smaller, especially with Bordeaux in comparison. Where Bordeaux has been able to compete is in these older vintages of legendary wines, where consumption has driven a scarcity of supply. Each case that is now opened will have a direct impact on that side of the equation.

Cheval ’90 has been volatile but is generally on the up and is well worth considering. I have included Pichon Baron ’90, only a 98+ according to Neal Martin but a Steven Spurrier legend, as it is so relatively cheap and has not broken out at all, so watch this space. The really obvious choice, however, is Mouton ’86. This wine at 32+ years is still a baby in terms of maturity but has an exciting life ahead. Its backwardness has had an impact on the wine’s supply but that will change. As ever good provenance is extremely important and as this is a wine that has been traded more than most so beware - we have seen many examples of poor condition. If this can be found in good nick, do not hesitate in acquiring it - it’s a legend!

Recommendation

Buy: Mouton ’86, Cheval Blanc ’90, Pichon Baron ‘90

Hold: if it’s a legend, continue to hold, for now at least…

N.B. Petrus ’89 and ’90 fall into the ‘legend’ definition but they are so expensive (c.£45,000 per 12) and rare, they have been excluded here.

Miles Davis - professional wine consultant working in the fine wine market. He has been a wine collector for thirty years and managed wine investment funds between 2006-17 for Wine Asset Managers LLP.

by Wine Owners

Posted on 2016-09-12

The WO First Growth Index showed price appreciation over the last 12 months pushed through the 20% threshold last week.

Haut Brion’s emergence as a wine that can now rivals its peers in the secondary market is clear, with 4 vintages in the top 10 movers, namely 2000, 2003, 2006 and 2008. Will we see Haut Brion close the gap where historically it would have sold at a discount to the other Firsts? The data seems to support the likelihood of this happening.

The top 10 movers have risen 23%-32% in the last year. Furthermore there has been just one faller out of the 75 constituents of the WO First Growth Index, namely Latour 2005.

Top 10 movers over the last 12 months

For the first time in years, we see a wine from the twin peaks of 2009 and 2010 in the top 10 movers, in the shape of the exceptional Margaux 2010. Scores from Robert Parker, Neal Martin and Stephen Tanzer oscillate in the 96-99 range, but the market is indicating it thinks that this could be a perfect wine. It’s now caught up with Haut Brion and Lafite at circa £540 per bottle.

Latour’s withdrawal from the en primeur business looks like paying dividends. Although the 2010’s value is far out in front of the field at £845 a bottle, it’s still not broken through it’s retail en primeur opening offer price of £950. Nevertheless it has performed well through the worst of the Bordeaux market’s 3-4 year slide, losing just 26% of its value by November 2015 before recovering, quite a decent performance compared with Lafite considering their similarly high release prices.

Can the Firsts continue this powerful recovery? Can they recapture the heights of their 2009 and 2010 release prices? If, so which will be the first ‘First’ to do so?

Least likely is Lafite, whose 2010 release price of £983 per bottle reflects a moment in time when Lafite was practically a Chinese barter currency, not to mention the 2009’s vertiginous release of £1,000. In each case there is a loss per per bottle of £440 versus en primeur retail.

Most likely to get back to even terms, in order of proximity of current market price vs opening retail offer price, is:

Latour 2010

Latour 2009

Margaux 2010

Haut Brion 2010

Confidence has returned and momentum is driving the market forward. If and when the current price of the above 4 wines exceeds their opening prices, and buyers of 2009 and 2010 First Growths no longer see a sea of red loss/gain percentages in their portfolios, confidence will be given a further boost.

by Wine Owners

Posted on 2016-07-25

It is fair to say that in the recent improvement of fortunes in Bordeaux prices, most focus is given to the classed growths of the Medoc on the Left Bank, and the top wines of Pomerol and St Emilion on the Right Bank. The recovery over the last 12 months has been significant, as seen below, with the Medoc Classed Growth Index (the turquoise line) rising by over 23% and the Libournais Index (purple line) up over 18%. Great news for all those people who have experienced the huge price correction of 2011 to 2014.

But, when looking at Bordeaux as a whole the focus should perhaps swing further south. See what happens when I add the Graves Classed Growth Index (the purple line in the chart, below) into the mix. Over the same time frame the wines of Graves, headlined by Haut Brion and la Mission Haut-Brion, have leapt up by over 30%, outstripping their neighbouring appelations.

Even when you take into account the Brexit effect, which has seen a weak pound in the past month provide a boost from sterling denominated stock as HK and US buyers pile in, this still represents a huge return to form. The lesson here is to realise that the 1855 classification (which ignores Graves, with the notable exception of Haut-Brion) and finest wines north of the Garonne are not the be all and end all. Look south, towards Graves, and you will find a raft of excellent wines that have improved dramatically in the last few years in many instances (think Smith Haut Lafitte, Haut-Bailly, Pape Clement), and which represent both great quality and great value. It is perhaps important that the gravelly, smoky, pencil lead and pencil shaving notes which characterise the best wines of Graves have few, if any, imitations around the world. Bordeaux blends from other continents tend to mimic the Medoc or the Libourne, and so the terroir-specific nature of Graves wines perhaps gives them a uniqueness that collectors ascribe value to in the same way as they do in Burgundy.

Sometimes it pays to take the path less travelled….

by Wine Owners

Posted on 2016-05-09

Before we jump into the 2015 En Primeur campaign with analysis and our recommendations of those Crus worth buying, let’s have a look at how last year’s 2014 En Primeur ‘picks’ have performed?

BACK VINTAGES THAT NEW RELEASES HIGHLIGHTED AS BUYS

Before we look at the performance of our 2014 top tips, it’s worth remembering that new releases nearly always shine a spotlight on comparable back vintages and help the market see where there’s value. Last year we focused on some Châteaux from back vintages that we felt were undervalued. Let’s see how they performed:

Chateau Haut Brion 2008

Last year we tipped Château Haut-Brion Premier Grand Cru Classé Pessac-Léognan 2008, priced at £ 2,400 per 12x75cl.

Today a Haut-Brion can be found at £ 2,800, an increase of 16.7% ( April 2016 ). We'd rate it a hold.

TASTING NOTES

"08 Château Haut Brion shows a good depth of color with dark ruby and purple hues. Fresh black raspberry, oak, tar, and spice are in abundance on the nose. The wine has a rich, opulent character. Multi-layered pure, ripe fruit and elegant tannins fill your mouth as you taste. The polished, balanced wine ends with an elegant, long, rich finish expressing purity in the fruit."

Robert Parker Score : 96/100

Chateau Palmer 2004

Last year Château Palmer 2004 cost was around £ 1,140 per 12x75cl.

Since last year, Château Palmer 2004 has risen to £ 1,390, an increase of 15.8%.

Robert Parker Score: 94

by Wine Owners

Posted on 2016-03-03

OWNER

Chateau Haut-Brion

APPELLATION

Pessac-Leognan

BLEND

Bordeaux Red Blend

AVERAGE SCORE

98/100

Haut-Brion 2005 initially enjoyed strong growth, peaking at £7,300 on the 30th September, 2008, ever since then however, the market value has dropped, reaching a trough of £4,561 in Jan 31, 2013. The price has plateaued to around its current value with little room for potential growth.

REVIEW

Another profound effort from Haut-Brion, the 2005 (a 9,000-case blend of 56% Cabernet Sauvignon, 39% Merlot, and the rest Cabernet Franc) has bulked up to the point that it is fair to compare it to the great successes of 1989, 1990, 1995, 1996, 1998, and 2000. A dark ruby/purple color is followed by a nuanced, noble bouquet of blue and red fruits interwoven with wet stones, unsmoked cigar tobacco, scorched earth, and spring flowers. The wine is full-bodied, pure, and complex as well as exceptionally elegant with laser-like precision. (Robert Parker, April 2008)