by Wine Owners

Posted on 2018-03-23

The KFFWII is up 9.6% over the year to March 2018, with a 2% gain in the last quarter.

Consolidation of the market at current valuation levels is on the back of the 24 months to December 2017, seeing gains of 38%.

The top of the market is significantly influenced by Asian demand, where a weak dollar is causing bid prices to fall. Changes within secondary market wine distribution into China may create a degree of uncertainty not seen since 2014.

The outlook for the rest of 2018 is one of subdued growth, with the Sterling-denominated index at risk of downward pressure as the currency appreciates against the US Dollar and Euro.

Bordeaux

First Growths are up just 3.8% over the last 12 months, half of which can be accounted for by the last 3 months. This broadly reflects the rest of the Bordeaux fine wine market (classified growths and equivalents). However, this subdued performance ought not to detract from 3-year performance (43% price growth) in First Growths, and 55% appreciation in the classified growths and equivalents over the same period.

Risers substantially outnumber fallers in Bordeaux, reflecting the market's continued overall growth. Less new wine is being released from chateaux than ever before, and quality is increasingly consistent. These factors point to continued growth during 2018, although it will remain in single figures, as orderly trading patterns continue.

Burgundy

Burgundy values continue to appreciate, with increases of 21% to March 2018, and 4.6% over the last quarter. To date there are no signs of a let-up in the upward trajectory of top producers' Burgundy prices. We’re about to see Burgundy price appreciation break through the 100% mark over the last 5 years, and reach 257% over 10 years.

Northern Italy

Northern Italy (represented in the KFFWII exclusively by Piedmont and Tuscany), is up 9.5% over the last 12 months, of which 2.7% is within the last quarter. The leaderboard is dominated by Monfortino, the standout Italian performer of the last 4 years which is consolidating its position as one of the most investible wines in the world.

Expectations for Northern Italy - Barolo in particular - are that prices will continue to increase into double digits over the remainder of 2018.

Champagne

Vintage champagne has performed well over the year, up a full 10%, and has kicked up 3% in the last quarter.

The best performers are rarer cuvees from such stalwarts as Selosse, Bollinger, Krug and Pol Roger. Over 10 years Champagne has performed even better than Burgundy, up 283%: demonstrating the liquidity that volume can drive, brand values and early consumption patterns.

USA

California’s moderated growth continues, with annual performance to March 2018 of 6.3%, and is up 2% within the last quarter. After years of bewilderingly strong growth (385% over 10 years), fallers are as numerous as risers within the California index, implying further downsides or a relatively flat outlook.

Spain

Top Spanish wines dominated by iconic and traditional large estates in Rioja and Ribero del Douro still represent good value, have good ageing potential, and are produced in large volumes.

These positive trading fundamentals support a market up 8.25% in the last year, and a healthy 3% in the last quarter.

A related effect is that Spanish blue-chips (particularly Vega Sicilia's top wines) are increasingly being traded on exchanges, and markets are being made for these wines through the usual offer and bid mechanisms used by market-makers.

The Spanish index is up 155% in the last 10 years. 45% of that growth has taken place in the last 3 years. The timing of that resurgence coincides with the inflection point in Bordeaux markets in the winter of 2015, when they rebounded from cyclical lows.

by Wine Owners

Posted on 2017-12-21

Broadening interest

2017 was a fascinating year for the wine market: a year of solid growth, consolidation and even a flash of speculation!

It was also a year of broader consumer interest reignited.

Knight Frank’s global Wealth Report includes analysis of the fine wine market provided by Wine Owners. Wine was by far the best-performing collectible asset of 2016,

up 24%. As a result, lots of positive press in 2017 brought plenty of new interest into the market.

Health

After the sharp price increases of 2016, when the Bordeaux market leapt as it rebounded off its 2014 lows following a couple of years of ticking up, 2017 was always going to be a less dramatic year for the classified and blue chip Bordeaux market.

It was encouraging to see a successful 2016 en primeur campaign that saw generally modest increases over 2015 in Euros, even if increases were more substantial for UK buyers due to the weakened currency. Overall gains in 2017 were low single-digit for

First Growths (after the 30% readjustment seen in the previous year). Other Classified growths and Right Banks rose an average of 7%.

Such moderation was less evident in the primary or secondary Burgundy market, the latter up 14.5%. What happens next is anyone’s guess, but the top of the market is holding onto 5-year gains of 100%, thanks in part to enduring Asian interest.

Hard luck stories

Burgundy was really hard hit by frosts in 2016. It’s a super vintage, but with many producer cellars that are 2/3rds empty. Only Vosne-Romanée and parts of Morey-St.-Denis and Gevrey-Chambertin escaped the April ‘gel’. Pretty much everywhere else was

heavily hit. The night-time freeze hit the Grand Crus and vineyards high up, the morning sun burned the buds of other premier crus and villages plots.

That big reduction in volume does add something to the intensity of the reds most noticeably. They are balanced, intensely redcurrant or blackcurrant in character, saline and fresh, with a vein of blood orange pulsing through them. The whites are fine

but don’t quite have the extraordinary rich, bright core of the 2014s, although in their favour the whites show more site specific character at this very early stage.

In 2017 Burgundy narrowly missed a second successive year of April misery, with an abundant vintage of good quality. Instead, Bordeaux was badly affected by freezing night-time temperatures in the last week of April, after a warm spring had encouraged

early growth. Some areas on the Right Bank, Graves and parts of the Medoc away from the warming waters of the Gironde were devastated. Chateaux de Fieuzel in Pessac isn’t making any wine in 2017.

What that will do to en primeur pricing next year remains to be seen, but widespread rises are on the cards, probably even those properties who emerged unscathed.

Notable winning regions

Champagne extended its run with top back vintages (where relative scarcity starts to play) racing ahead, up 13% in 2017. The world’s appetite for Champagne remains insatiable.

It was gratifying to see Northern Italy in rude health, with interest for Barolo Crus broadening significantly and prices of the best producers very sharply up this year on the back of a string of good vintages culminating in the highly sought after 2013s.

Speculation

Talking of that flash of speculation, Margaux 2015 announced in November that Margaux would release their 2015 as a special edition in honour of Paul Pontallier, the managing director of the estate who died in March 2016.

We saw the first release from the chateau, offered in individual single wooden cases, at a significant premium to the release price.

Based on the Chateau’s announcement, we saw speculative trading in the wine between EP club members rise and rise, with bids climbing from under £6,000 to £12,000, representing more than a 130% increase compared to the release price to UK consumers of

£4,650.

The limited edition black bottles with a variation on the classic Margaux label in gold invited comparison with the 2000 Mouton Rothschild, which attracts a significant market following based on collectability, despite not being in the top flight of Mouton

vintages or even one of the best wines of the vintage.

Looking ahead to 2018

If you're interested to learn more about the health of the fine wine market and are interested in our predictions for 2018, you can now download our Fine Wine Predictions 2018 report, a must-read for collectors, wine lovers looking for value, and investors searching for opportunities.

DOWNLOAD PREDICTIONS 2018 REPORT

* * *

We wish you all a very enjoyable festive season, and much vinous pleasure as you open great wine bottles to celebrate and see in 2018.

Best wishes for health and happiness from the Wine Owners team!

by Wine Owners

Posted on 2015-02-16

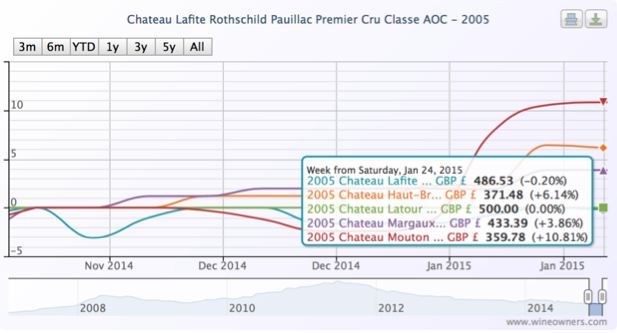

The turning point for fine Bordeaux was August of last year. By early October it was unclear whether the tick-up was yet another of those blips we’d seen several of during the previous 24 months.

Today it is clearer: the trend is up, most wines are well off their lows, and the Bordeaux Index overall is 2.17% up on 6 months ago.

The exception is the Libournais index covering Pomerol and St Emilion, which has slipped 0.48%, a reversing the gains of 1.24% between early October and the end of November last year.

The Medoc Classed Growths are collectively up 2.77% form their August 9th 2014 lows.

Whereas the First Growths only managed 1.51% during the same period. Not entirely surprising since top vintages are still highly priced, they have had further to fall, making it hard to call bottom, and started picking up momentum in January 2015. What is clearer is that wines such as Haut Brion 2008 appear to be interesting propositions.

Elsewhere the Blue Chip Burgundy Index continues to power ahead, though within that there are notable, and expensive, fallers (last 12 months):

| Domaine de la Romanee-Conti Le Montrachet Grand Cru AOC |

2010 |

-7.16 |

| Domaine Ponsot Charmes Chambertin Cuvee des Merles Grand Cru AOP |

2010 |

-7.69 |

| Domaine Armand Rousseau Mazis-Chambertin Grand Cru AOC |

2010 |

-7.89 |

| Domaine Jean Grivot Richebourg Grand Cru AOC |

2007 |

-9.43 |

| Domaine de la Romanee-Conti Romanee Saint Vivant Grand Cru AOC |

2010 |

-10.71 |

| Domaine Jean Grivot Echezeaux Grand Cru AOC |

2002 |

-11.2 |

| Domaine Leflaive Batard-Montrachet Grand Cru AOC |

2006 |

-13.15 |

| Sylvain Cathiard Vosne Romanee En Orveaux Premier Cru AOC |

2010 |

-13.69 |

| Domaine Comte Georges de Vogue Chambolle Musigny Les Amoureuses Premier Cru AOC |

2002 |

-13.7 |

| Domaine de la Romanee-Conti La Tache Monopole Grand Cru AOC |

2010 |

-15.38 |

| Domaine Armand Rousseau Clos de la Roche Grand Cru AOC |

2010 |

-16.08 |

| Domaine Leflaive Batard-Montrachet Grand Cru AOC |

2005 |

-16.18 |

| Domaine Jean-Francois Coche-Dury Corton-Charlemagne Grand Cru AOC |

2006 |

-16.35 |

| Domaine Leflaive Chevalier-Montrachet Grand Cru AOC |

2005 |

-16.67 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2008 |

-20 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2006 |

-20.16 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2005 |

-21.94 |

Northern Italy is up 1.42%, with Giacomo Conterno one again heading the leaderboard

Champagne has defied our predictions in gaining a whopping 7.42% over the last 6 months, the top risers comprising exclusively older vintages in the range 1996-2002. This makes a lot of sense. Millions of bottles of top cuvees such as Dom Perignon (up to 8M bottles per annum) means that values kick up only when supply and demand becomes more balanced.

We also thought Californian wines would moderate their growth this year. Comparative to Bordeaux prices, they seem expensive. Since January they have indeed dipped -0.65%, off the back of six month growth of 6.65% up until that point. It’s too early to say whether they are simply pausing for breath, or have reached a natural plateau. The trend line favours the first scenario.

by Wine Owners

Posted on 2014-10-17

Treasure assets are uncorrelated. That’s part of the attraction to high net worth individuals (HNWIs) looking for suitable stores of value.

I use the phrase store of value purposefully. Wealth preservation and enjoyment of the fruits of success are arguably far more important to HNWIs than specific targeted annual returns.

Wine has appeared deeply uncorrelated since the financial crisis of 2008. The facts bear that out. Yet we mustn’t forget the power of externalities to distort underlying tendencies; such as insatiable demand from China up until mid-2011, or the flight from traditional financial instruments during periods of extreme market stress into all things tangible. It’s easy to forget that the wine market did suffer during previous economic recessions or shocks, whether the recession of the early 1990s or the Asian financial crisis of 1997.

Yes, of course we’re talking principally about Bordeaux, that behemoth of a region that produces unrivalled oodles of fine red wine. Paradoxically other regions of production may indeed be uncorrelated with Classed Growth Bordeaux as hot wine money searches for relative value, or where scarcity creates a rather different drumbeat.

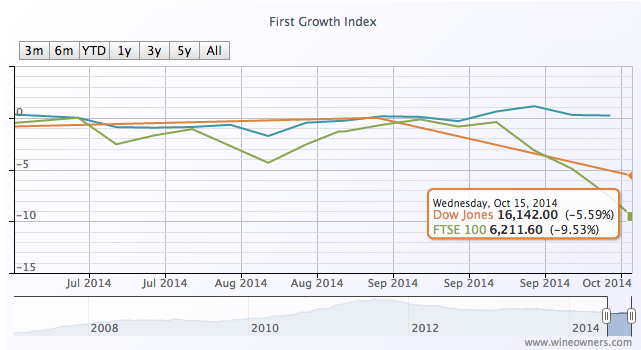

With the current financial market turmoil; the sudden reawakening to the woes of Europe; the economic and political uncertainty of its recession-hit member states - what better moment to analyse the question of market correlation?

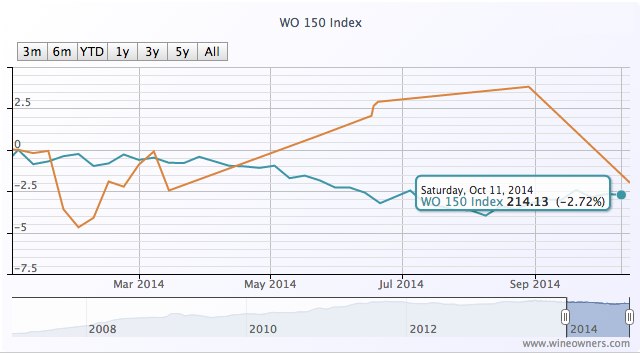

The wine market became quite excited by a small upturn that started in late July, continued during August and through much of September. A month on, and things aren’t quite so clear-cut, but in spite of plummeting stock markets, wine prices are not following suit.

The First Growth Index is up by 1.2% over the last 3 months whilst the FTSE has dived almost 8% - that’s roughly the same amount of value destruction as the First Growths experienced over the previous 12 months. The Bordeaux Index has followed the same positive (if tentative) trajectory (comprising Medoc and Graves Classed Growths and the top Libournais benchmarks). So has Northern Italy, only a whisker off its all-time highs, along with blue chip Burgundy and the effervescent Champagne market.

After a disappointing year so far for the wine market overall (represented by the WO 150 Index), the previously run-away Dow is within single-digit, fingertip distance of fine wine’s -2.7% fall.