by Wine Owners

Posted on 2015-06-04

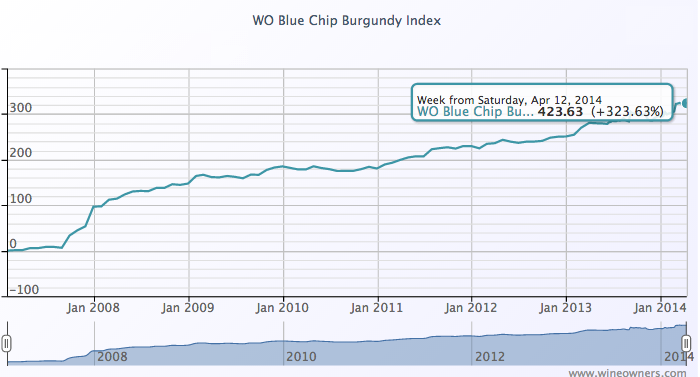

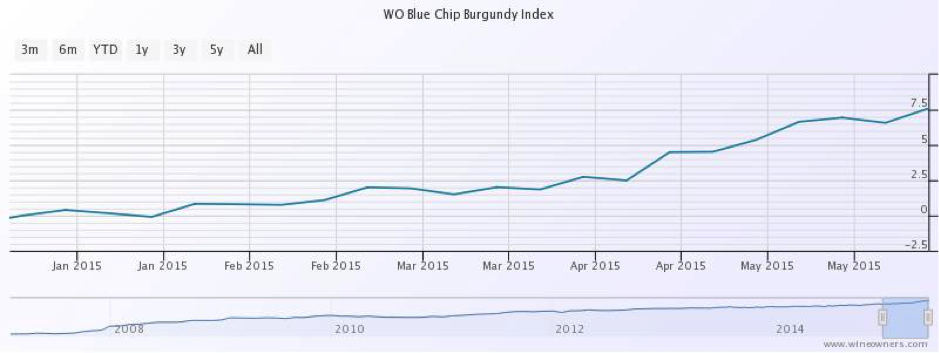

The WO Blue Chip Burgundy index continues to power ahead, up 5% in just 7 weeks.

Has this rise been driven by recent demand and auction performances in Hong Kong, or are we just seeing the latest kick upwards driven by increasingly difficult-to-find wines in the face of growing global appreciation?

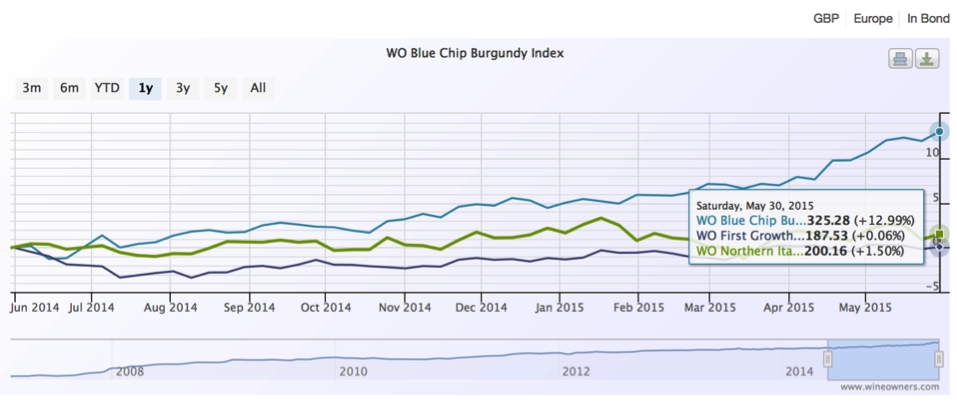

Whilst to 2010 DRCs have fallen over the last year by 7-10%, the scarcest wines from blue chip producers have registered strong double-digit growth in the last year.

Burgundy is substantially outperforming Bordeaux First Growth performance and Northern Italy. First Growths show flat performance over the last 12 months, whilst Northern Italy has edged up by 1.5%.

You can see performance of indices and their constituent wines here.

by Wine Owners

Posted on 2015-02-16

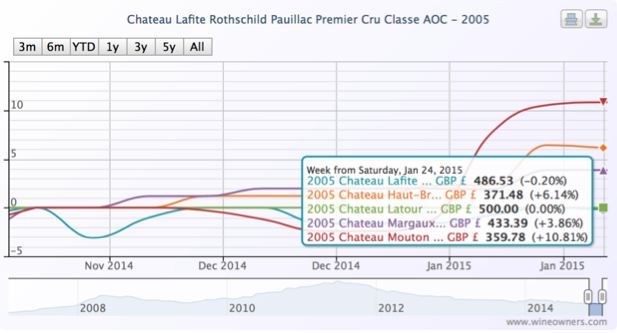

The turning point for fine Bordeaux was August of last year. By early October it was unclear whether the tick-up was yet another of those blips we’d seen several of during the previous 24 months.

Today it is clearer: the trend is up, most wines are well off their lows, and the Bordeaux Index overall is 2.17% up on 6 months ago.

The exception is the Libournais index covering Pomerol and St Emilion, which has slipped 0.48%, a reversing the gains of 1.24% between early October and the end of November last year.

The Medoc Classed Growths are collectively up 2.77% form their August 9th 2014 lows.

Whereas the First Growths only managed 1.51% during the same period. Not entirely surprising since top vintages are still highly priced, they have had further to fall, making it hard to call bottom, and started picking up momentum in January 2015. What is clearer is that wines such as Haut Brion 2008 appear to be interesting propositions.

Elsewhere the Blue Chip Burgundy Index continues to power ahead, though within that there are notable, and expensive, fallers (last 12 months):

| Domaine de la Romanee-Conti Le Montrachet Grand Cru AOC |

2010 |

-7.16 |

| Domaine Ponsot Charmes Chambertin Cuvee des Merles Grand Cru AOP |

2010 |

-7.69 |

| Domaine Armand Rousseau Mazis-Chambertin Grand Cru AOC |

2010 |

-7.89 |

| Domaine Jean Grivot Richebourg Grand Cru AOC |

2007 |

-9.43 |

| Domaine de la Romanee-Conti Romanee Saint Vivant Grand Cru AOC |

2010 |

-10.71 |

| Domaine Jean Grivot Echezeaux Grand Cru AOC |

2002 |

-11.2 |

| Domaine Leflaive Batard-Montrachet Grand Cru AOC |

2006 |

-13.15 |

| Sylvain Cathiard Vosne Romanee En Orveaux Premier Cru AOC |

2010 |

-13.69 |

| Domaine Comte Georges de Vogue Chambolle Musigny Les Amoureuses Premier Cru AOC |

2002 |

-13.7 |

| Domaine de la Romanee-Conti La Tache Monopole Grand Cru AOC |

2010 |

-15.38 |

| Domaine Armand Rousseau Clos de la Roche Grand Cru AOC |

2010 |

-16.08 |

| Domaine Leflaive Batard-Montrachet Grand Cru AOC |

2005 |

-16.18 |

| Domaine Jean-Francois Coche-Dury Corton-Charlemagne Grand Cru AOC |

2006 |

-16.35 |

| Domaine Leflaive Chevalier-Montrachet Grand Cru AOC |

2005 |

-16.67 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2008 |

-20 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2006 |

-20.16 |

| Domaine Leflaive Le Montrachet Grand Cru AOC |

2005 |

-21.94 |

Northern Italy is up 1.42%, with Giacomo Conterno one again heading the leaderboard

Champagne has defied our predictions in gaining a whopping 7.42% over the last 6 months, the top risers comprising exclusively older vintages in the range 1996-2002. This makes a lot of sense. Millions of bottles of top cuvees such as Dom Perignon (up to 8M bottles per annum) means that values kick up only when supply and demand becomes more balanced.

We also thought Californian wines would moderate their growth this year. Comparative to Bordeaux prices, they seem expensive. Since January they have indeed dipped -0.65%, off the back of six month growth of 6.65% up until that point. It’s too early to say whether they are simply pausing for breath, or have reached a natural plateau. The trend line favours the first scenario.

by Wine Owners

Posted on 2014-10-17

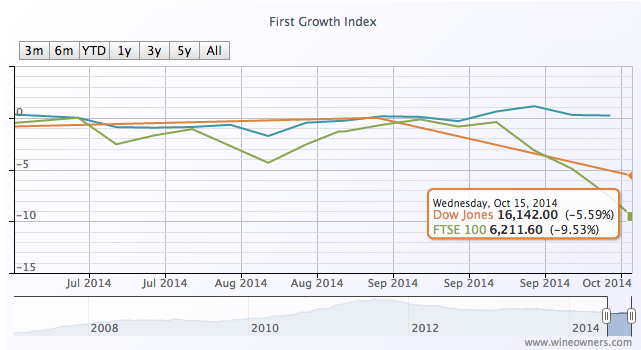

Treasure assets are uncorrelated. That’s part of the attraction to high net worth individuals (HNWIs) looking for suitable stores of value.

I use the phrase store of value purposefully. Wealth preservation and enjoyment of the fruits of success are arguably far more important to HNWIs than specific targeted annual returns.

Wine has appeared deeply uncorrelated since the financial crisis of 2008. The facts bear that out. Yet we mustn’t forget the power of externalities to distort underlying tendencies; such as insatiable demand from China up until mid-2011, or the flight from traditional financial instruments during periods of extreme market stress into all things tangible. It’s easy to forget that the wine market did suffer during previous economic recessions or shocks, whether the recession of the early 1990s or the Asian financial crisis of 1997.

Yes, of course we’re talking principally about Bordeaux, that behemoth of a region that produces unrivalled oodles of fine red wine. Paradoxically other regions of production may indeed be uncorrelated with Classed Growth Bordeaux as hot wine money searches for relative value, or where scarcity creates a rather different drumbeat.

With the current financial market turmoil; the sudden reawakening to the woes of Europe; the economic and political uncertainty of its recession-hit member states - what better moment to analyse the question of market correlation?

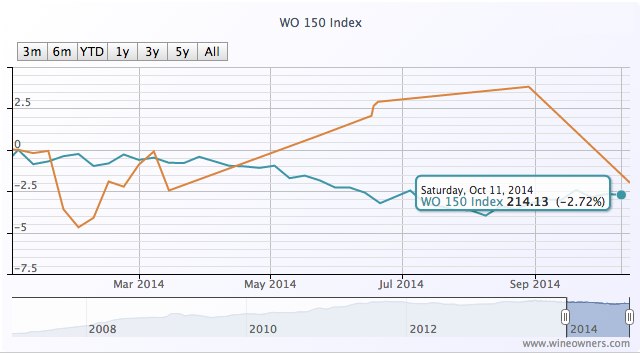

The wine market became quite excited by a small upturn that started in late July, continued during August and through much of September. A month on, and things aren’t quite so clear-cut, but in spite of plummeting stock markets, wine prices are not following suit.

The First Growth Index is up by 1.2% over the last 3 months whilst the FTSE has dived almost 8% - that’s roughly the same amount of value destruction as the First Growths experienced over the previous 12 months. The Bordeaux Index has followed the same positive (if tentative) trajectory (comprising Medoc and Graves Classed Growths and the top Libournais benchmarks). So has Northern Italy, only a whisker off its all-time highs, along with blue chip Burgundy and the effervescent Champagne market.

After a disappointing year so far for the wine market overall (represented by the WO 150 Index), the previously run-away Dow is within single-digit, fingertip distance of fine wine’s -2.7% fall.

by Wine Owners

Posted on 2014-05-08

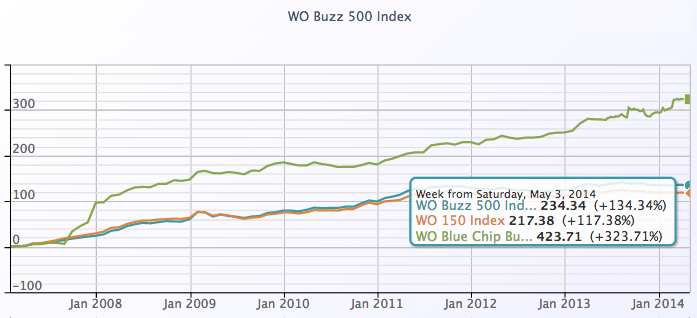

The Buzz 500 was always meant to be a bit of fun. Away from the serious business of formulating the fine wine equivalent of the FTSE100, and key region of production tracker indices, we thought it would be interesting to create a ‘popular’ index.

So we took the 100 most searched for wine names on Wine-Searcher, selected 5 vintages per wine that differed according to region, and turned that list into an index. Well, why not?

We wanted answers to the question: are those wines that are most searched for on Wine-Searcher also those that perform the best over the medium term? Will the most searched-for wines tend to be the most demanded? Does most researched translate into purchases, and does that lend support to, or underpin market pricing?

We kicked off the Buzz 500 at the start of 2013, and from that point onwards, it’s outperformed the WO150. That’s not entirely surprising given the strong Bordeaux representation in the latter index. But actually the Buzz 500 has plenty of claret represented too, just different wines. This highlights the first conclusion: there are always outperformers in any segment, and there is a correlation between the most searched for wines in a category and their performance versus other birds of a feather.

You can Review the constituents of each of the indexes here.

But just because hot wines within a category will outperform other wines in the same category, there’s no substitute for market momentum: and nowhere has that been greater than in burgundy these past three years.

So comparing the Buzz 500 to the Blue–chip Burgundy index is – well, rather predictable.

Whilst Burgundy has risen 40% in the last 3 years, the Buzz 500 has managed a paltry 5.5%. That’s still a third better than the poor WO150, weighed down by its First Growth constituents.

If you're a Burgundy officianado that may be good news, or conversely may have put whole classifications of wine out of your drinking reach. And whilst the scarcity of Burgundy is a huge market driver that may point to inexorable upwards momentum, who’s to say it will continue?

The wine market is characterised by myopia – unable or unwilling to see an end to positive trends, and morose in the extreme when sentiment turns . Neither are helpful for collectors.

One behaviour that is consistently predictable is that when wine markets become disconnected with the value in those purses that consume it, the trade and consumers search for better value, Hence the positive kick enjoyed by Northern Italy. More about that in my next index analysis.

by Wine Owners

Posted on 2014-04-22

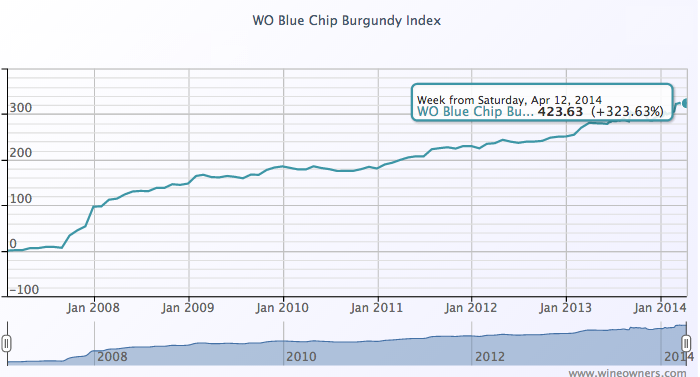

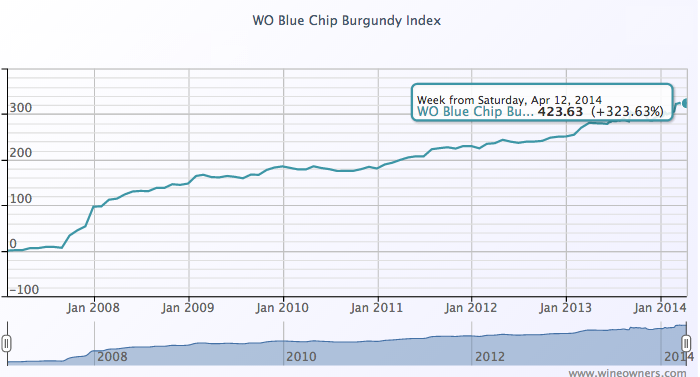

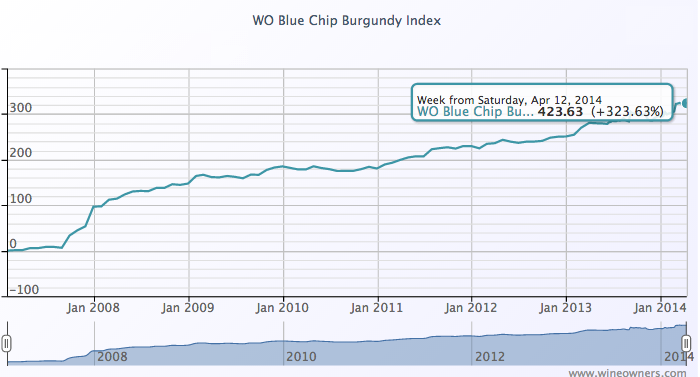

The Blue Chip Burgundy Index is focused on Grand Cru and a small number of top Premier Cru burgundy from the region’s top producers.

These wines are difficult to get allocated at first release in the first calendar quarter two years after harvest, and tend to jump in value as soon

The Blue Chip Burgundy Index is focused on Grand Cru and a small number of top Premier Cru burgundy from the region’s top producers.

These wines are difficult to get allocated at first release in the first calendar quarter two years after harvest, and tend to jump in value as soon as they find their way into the secondary market - such is the competition to own them. So buying in at first release gives the buyer the greatest upside, yet as the graph shows, the upward trend has been irresistible over the last 7+ years.

Once acquired, a significant proportion of these wines never see the light of day again except for when a cork is pulled a decade or so after release. Such is the passion for great burgundy. Does the incredible market performance over the last few years change that we wonder, as more elite producer wines become ultra-expensive - and straying into the lower reaches of DRC, Leroy and Jayer price territory? Nothing has performed as well as fine burgundy in this period, and burgundy’s charted performance (blue) versus the Medoc and Libournais indices (green and orange respectively) looks even more dramatic when compared over the last 3 years.

as they find their way into the secondary market - such is the competition to own them. So buying in at first release gives the buyer the greatest upside, yet as the graph shows, the upward trend has been irresistible over the last 7+ years.

Once acquired, a significant proportion of these wines never see the light of day again except for when a cork is pulled a decade or so after release. Such is the passion for great burgundy. Does the incredible market performance over the last few years change that we wonder, as more elite producer wines become ultra-expensive - and straying into the lower reaches of DRC, Leroy and Jayer price territory? Nothing has performed as well as fine burgundy in this period, and burgundy’s charted performance (blue) versus the Medoc and Libournais indices (green and orange respectively) looks even more dramatic when compared over the last 3 years.