by Wine Owners

Posted on 2016-09-12

The WO First Growth Index showed price appreciation over the last 12 months pushed through the 20% threshold last week.

Haut Brion’s emergence as a wine that can now rivals its peers in the secondary market is clear, with 4 vintages in the top 10 movers, namely 2000, 2003, 2006 and 2008. Will we see Haut Brion close the gap where historically it would have sold at a discount to the other Firsts? The data seems to support the likelihood of this happening.

The top 10 movers have risen 23%-32% in the last year. Furthermore there has been just one faller out of the 75 constituents of the WO First Growth Index, namely Latour 2005.

Top 10 movers over the last 12 months

For the first time in years, we see a wine from the twin peaks of 2009 and 2010 in the top 10 movers, in the shape of the exceptional Margaux 2010. Scores from Robert Parker, Neal Martin and Stephen Tanzer oscillate in the 96-99 range, but the market is indicating it thinks that this could be a perfect wine. It’s now caught up with Haut Brion and Lafite at circa £540 per bottle.

Latour’s withdrawal from the en primeur business looks like paying dividends. Although the 2010’s value is far out in front of the field at £845 a bottle, it’s still not broken through it’s retail en primeur opening offer price of £950. Nevertheless it has performed well through the worst of the Bordeaux market’s 3-4 year slide, losing just 26% of its value by November 2015 before recovering, quite a decent performance compared with Lafite considering their similarly high release prices.

Can the Firsts continue this powerful recovery? Can they recapture the heights of their 2009 and 2010 release prices? If, so which will be the first ‘First’ to do so?

Least likely is Lafite, whose 2010 release price of £983 per bottle reflects a moment in time when Lafite was practically a Chinese barter currency, not to mention the 2009’s vertiginous release of £1,000. In each case there is a loss per per bottle of £440 versus en primeur retail.

Most likely to get back to even terms, in order of proximity of current market price vs opening retail offer price, is:

Latour 2010

Latour 2009

Margaux 2010

Haut Brion 2010

Confidence has returned and momentum is driving the market forward. If and when the current price of the above 4 wines exceeds their opening prices, and buyers of 2009 and 2010 First Growths no longer see a sea of red loss/gain percentages in their portfolios, confidence will be given a further boost.

by Wine Owners

Posted on 2015-10-29

Quite a lot of members we speak to these days assume that the market prices of Bordeaux are still stagnating or falling. The morosité that had descended on the region's finest wines in by 2012 does not appear to have lifted.

Wine traders will point to volumes that are much reduced since the giddy heyday of 2009-2011, and that is of course true.

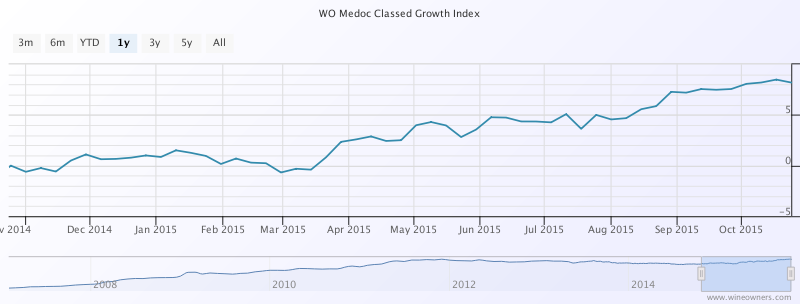

However, it does not mean that in aggregate, prices of Bordeaux have begun an upward trend. In the last year, the Wine Owners Medoc Classed Growth Index is up 8.2%.

Whereas the Wine Owners First Growth Index has only managed half of that in the last year, up 4.1%.

That's still better than the performance of the FTSE100, which is fractionally underwater over the last year, and exactly where the S&P500 has clawed it's way back to after the summer's wobbles.

Wine Owners 150 = Turquoise

FTSE100 = Navy

S&P500 - Green

However, when looking at First Growth performance over the last 12 months, it is far from broad-based. 'The further they rise, the longer they fall' seems to hold true, with Lafite 1986 and 1989 performing the worst at -8% and -9% respectively.

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1999 | -5.45% | £ 216.68 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 2006 | -5.75% | £ 286.67 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2009 | -5.82% | £ 441.67 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1982 | -5.92% | £ 436.68 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1982 | -6.29% | £ 1,810.14 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1998 | -7.15% | £ 270.83 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2006 | -7.26% | £ 212.50 |

| Chateau Margaux Premier Cru Classe AOP | 1989 | -7.59% | £ 250.10 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1986 | -8.13% | £ 651.48 |

| Chateau Lafite Rothschild Pauillac Premier Cru Classe AOP | 1989 | -9.11% | £ 395.92 |

Among the vintages populating negative territory, 1986 has suffered with the exception of the very great Mouton. The exceptional 1989s and 1990s have fallen, along with with the dull 1999s.

The risers are headed by Mouton, Haut Brion and Latour. The top 10 performers registering double digit growth are entirely accounted for by these three Châteaux.

| Wine | Vintage | Change 1 year | Price |

|---|

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2005 | 22.39% | £ 366.67 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2008 | 21.13% | £ 262.54 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2005 | 20.95% | £ 437.50 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 1996 | 16.87% | £ 282.74 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1990 | 14.30% | £ 429.12 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 2005 | 13.36% | £ 566.79 |

| Chateau Mouton Rothschild Pauillac Premier Cru Classe AOP | 2000 | 13.32% | £ 1,038.81 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 2008 | 11.00% | £ 226.64 |

| Chateau Haut-Brion Pessac-Leognan Premier Cru Classe AOP | 1989 | 9.08% | £ 1,000.03 |

| Chateau Latour Pauillac Premier Cru Classe AOP | 1995 | 8.49% | £ 316.67 |

Crossing over to the right bank, predominant top performers over the last 12 months are St EmillMedoc Classed Growth Indexon 2005s and the 2001 Class A relative newcomers. Since March 2015 The Wine Owners Libournais Index is up 7%, coming off it's 3 year lows at that point.

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2005 | 53.85% | £ 300.00 |

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2001 | 48.07% | £ 176.57 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 2001 | 45.67% | £ 183.46 |

| Chateau Angelus Saint Emilion Premier Grand Cru Classe A AOP | 2000 | 37.16% | £ 301.79 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 1998 | 34.59% | £ 161.84 |

| Chateau Larcis Ducasse Saint Emilion Premier Grand Cru Classe B AOP | 2005 | 27.82% | £ 110.96 |

| Chateau Pavie Saint Emilion Premier Grand Cru Classe A AOP | 2005 | 26.84% | £ 232.57 |

| Chateau La Violette Pomerol AOP | 2009 | 26.67% | £ 208.33 |

| Chateau Cheval Blanc Saint-Emilion Premier Grand Cru Classe A AOP | 2005 | 24.71% | £ 433.34 |

What can we conclude from this? Some commentators are suggesting that value is returning to older back vintages on the back of 4 year declines. Relative value vs quality is likely to be a key driver of future value, for which we recommend you check out the new price per points builder on Wine Owners to which you'll need to subscribe.

Liv-ex have recently seen a predominance of trades of the 2010 vintage, and whilst there seems to be value returning selectively to the Classed Growths, one wonders if it's a little early yet the First Growths, whose starting release prices were in nose-bleed territory. Since 'the further they rise, the longer they fall' it may yet be a bit early to call.