by Wine Owners

Posted on 2017-03-22

Few producers ever achieve the magical 100 point rating from the Wine Advocate. Parker’s ratings have been the most influential in the world, so to achieve the magic century is quite some accolade; to achieve it more than once is the stuff of dreams; to achieve it 28 times as have Guigal’s famed Cote Rotie triumvirate of La Landonne, La Turque and La Mouline (collectively nicknamed ‘the La Las’) is unprecedented. No other producer from a single appellation comes close.

You might have thought that these three wine with a claim to be among the finest in the world should cost the earth, shouldn’t they? Well, in fact they don’t – at least not in comparison with the finest wines of Bordeaux, Burgundy and California.

For the purposes of this analysis we’re going to look at the 2009 vintage, which paints a fairly typical picture for these wines. Historically there is very little variation in the values of the three wines, with prices often within a 3% range. So, this chart for La Mouline ’09 is mirrored closely by the other two. What is immediately noticeable is that prices have, until midway through last year, fallen consistently. This despite two 100 point scores in November 2013 and September 2014!

The fall in price is on a par with the falls in value of Bordeaux wines in the same period, but importantly the La Las did not have a huge price rise immediately prior to the falls that insulated many buyers from the slump. It seems, on the face of it that Guigal’s amazing wines were simply the victim of a lack of global interest in Rhone wines at the top end.

This seems to be changing however, as over the last 6 to 9 months the relatively attractive pricing has found favour, and sentiment seems to have turned positive. All good vintages across all three wines are moving upwards, and demand is out-stripping supply for the first time in many years.

La Mouline 09 is 15% up since July, and is on its way back to the £4000 a case level last seen in early 2013. In our view there is reason* to be confident that this recovery is a fundamental re-evaluation of the value of the wine, rather than simply the beneficial effect of weak Sterling, and there is definitely reason* to add this to a cellar, for both investment and drinking purposes.

So, what is this reason you may well ask?

Sadly, the La La’s were among the chosen wines of various boiler room, sales led operations who decided that they were ideal wines to sell as investments to unsuspecting investors at way over fair market prices. This created skewed pricing and led to reputational damage to the wines that caused prices to drop. Thankfully most of these operations have now closed down, and their negative impact on the market has dissipated. The secondary market is now a healthier place for these great wines, and prices are once again reflecting the supreme quality and longevity of Rhone’s finest.

by Wine Owners

Posted on 2016-02-02

No, we’re not referring to an ancient Microsoft operating system release, but to a potential purchasing window for Bordeaux 2000.

Word on the street is that there could be a bumper set of new reviews released this year of 2000 claret on erobertparker.com – 15 years on.

And why not, it’s one of the 4 greatest last vintages, alongside or after 2005, 2009 and 2010.

The wines show effortless balance, are precise and richly fruited, and in the case of top classified crus, are still at a very early stage of their evolution, with their peak years still ahead of them.

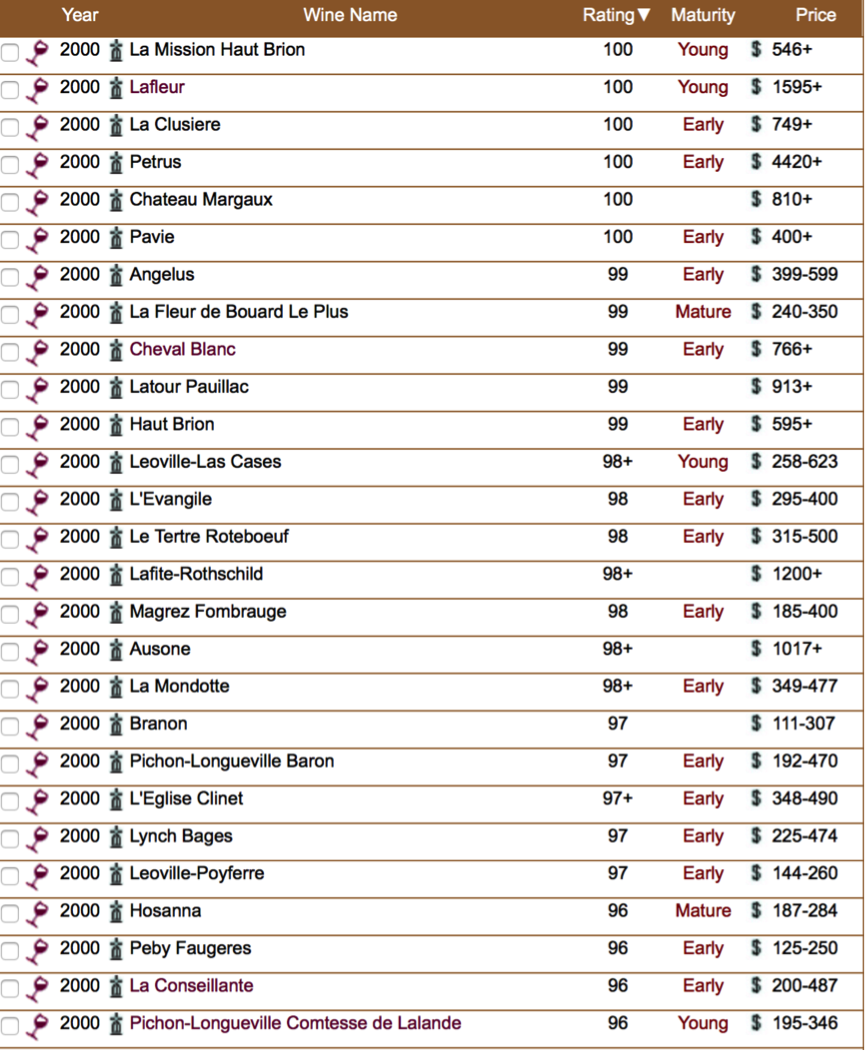

Those wines that are re-rated positively this year will increase in value, in a vintage where there are still plenty of values to be had. With so many wines within a few points of perfect 100 scores, there’s plenty to speculate about which could be worthy of a rerating.

Take relative values, for example a number of wines that were last rated at 98(+) points. This is a helpful starting point for seeing where short-term opportunities may exist.

We’re inclined to rule out big and bouncy productions such as Magrez Fombrauge as the world swings away from extracted winemaking in favour of definition and a degree of finesse. We can all have our biases after all, market commentators and critics alike!

Once value relative to peers is established, it’s then worth cross checking value of a selected with other comparable vintages.

Now let’s take L’Évangile as a case in point:

Based on this analysis would you buy into 2000 or 2010? We’ve ruled out 2009 on the basis that a) it’s already 100 points and b) it’s an über-fruity 15° number.

The following table shows the scores, predominantly from the 20 years-on retrospective published in 2010.

Source: erobertparker.com

by Wine Owners

Posted on 2014-05-09

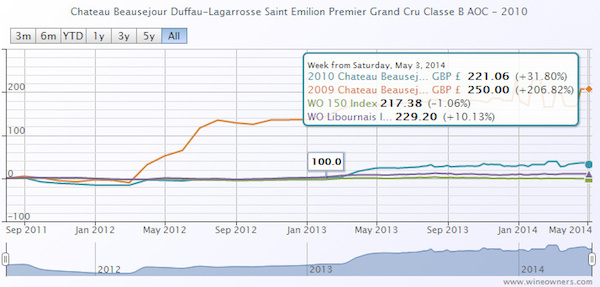

Beausejour Duffau is a great success story of recent years, especially if you are one of the buyers lucky enough to have secured an allocation of the 2009 (in particular) and 2010, both of which received price-boosting perfect ratings from Wine Advocate. The 2009, for example, which has been trading at £2850 has shown nothing but upside since release. The opening EP price here was £800, which is enough to deter the casual buyer, but those who fell in love with the wine from barrel samples have had their faith well rewarded by a market price of £3000, an increase of 270%, which is truly remarkable in an otherwise relatively stale market, and vastly outstrips the performance of pretty much anything else.

Buyers of the 2010 show an increase of around 30%, still very much bucking the trend, but slightly less favoured than the 2009, with an equivalent market price of £2652. Given the release price of the 2010, close to £2000 per case, buyers in that vintage were in a sense late to the party, the chateau having had the confidence to price quite aggressively in its second consecutive great vintage. The pricing performance here is probably also coloured by the fact that the 2009 was given a range of 96-98+ in initial tastings by Parker, while the 2010 was offered a marginally more confident 96-100, both being respectively upgraded and confirmed in a 100 point score.

Lucky owners of the 2009 are left in the enviable if awkward position of having to decide whether to take their £2000 per case profit now, or hold in anticipation of future increases (the last perfect score for Beausejour Duffau was 1990 which now trades at £7,500+ per case and has consistently risen since 2006).

There is always the option of laying it down for future drinking in the knowledge that it’s a 100 point wine for which they paid well below the odds on release. Given 2009 is in all likelihood a decade away from entering its maturity plateau, how many savvy buyers will be prepared to drink a case of wine that might be valued at £7,500-£10,000 by then?

by Wine Owners

Posted on 2014-01-06

Worthy of attention on the Exchange this week as a value proposition is the 2010 Coparossa Barbaresco from Bruno Rocca, which outperforms the theoretically superior 2007 vintage but still comes in marginally lower priced (the 2007 appears in the UK market at a low of £211). The Coparossa is effectively a ‘vieilles vignes’ cuvee, sourced from older plantings in First floors of Neive and Treiso, so marks a qualititative step up from the straight Barbaresco bottling, from younger vines, but is not a single vineyard cuvee like the Rabaja. Antonio Galloni and Wine Advocate seem to be in accord that the 2010 Coparossa is the best yet made from a producer who seems to be very much on an upward trajectory in terms of quality and reputation.

According to Galloni, it’s clear from what he has tasted that ‘the best wines from this small, family-run domaine have yet to be made, and that is more than enough to be energised about what is happening here.’ With a constant build in quality, and the fact that in many vintages the Coparossa outscores the single vineyard bottling, the 2010 vintage looks like decidedly good value.

“The 2010 Barbaresco Coparossa brings together the structure of the year with a huge core of fruit, a combination that is hugely appealing. Dark red cherry, plum, cinnamon, licorice and leather all blossom in an expressive, layered wine loaded with personality. With time in the glass, the wine turns explosive. Orange zest, rose petals and cloves linger on the exotic finish. The style is energetic, tense and vibrant.”

95 (1997- 93 pts) Antonio Galloni, Vinous Media

“The 2010 Barbaresco Coparossa is extremely elegant and refined with dried flowers, herbal notes, bright cola and Pinot-like softness. This is a stunning effort. The wine is irresistibly silky and sensuous on the palate, imparting clean fruit flavors that last long on the finish. It delivers fabulous length with seemingly never-ending intensity and persistency.”

Anticipated maturity: 2015-2028.

96 points, Monica Larner, Wine Advocate