by Wine Owners

Posted on 2022-10-05

Only a couple of weeks ago the wine market felt like it does quite a lot of the time; a bit of a backwater, no great trends or swings, business as usual. Most things were just floating along calmly on their predicted journey while little pools continued to defy gravity, even though it would appear to make no logical sense; the highly prized Salon 2002 for example, having doubled and tripled in two to three years was in high demand - the joys of rarity are a thing to behold when such demand is in town! (I have sold some of this treasured holding on behalf of clients).

And then along came a newly formed Conservative government who decided they needed to bet the house on the UK economy, cutting taxes in order to promote growth, and wiped 10% off the value of the British pound in the process, and in record quick time. Tax cut reversals have now taken place and sterling has rallied a little although it remains at a much lower level than a year ago:

GBP/USD one year chart

Source: Yahoo Finance

This is unbridled joy for US dollar-based wine traders, which includes the powerful markets of North America, Hong Kong and Singapore, amongst others. Following the latest slide, we have seen some reasonably stale offers of quality stocks suddenly sell and UK traders across the board are reporting increased interest from these areas.

As a result, my personal take on the market has gone from a neutral stance to something more optimistic than that.

I have always held the belief that there is more demand in the US market for the wines of Piedmont and Italy in general given the obvious connections of heritage, and also for Chateauneuf du Pape (or C9P as I saw it written recently!). Mr. Parker had a penchant for handing out incredibly high scores for C9P back in the day which will have helped but it is also felt that America has a higher tolerance for sun kissed, more alcoholic (more than the Europeans are used to at least) juice. Asia does not yet seem to share these particular tastes in these regions but are very happy to continue buying Burgundy and Bordeaux. Everyone continues to buy Champagne, for very good reasons, so that is a large percentage of the market covered already!

I would not be at all surprised to see US wine stocks being exported from the UK back to the USA and feel that back vintages of highly prized Napa wines make strong sense.

Looking ahead, UK buyers in the primary markets for wine will be severely affected by sterling’s weakness in the coming months and their pockets will be stretched, so back vintages of well stored investment grade, quality stocks already in the secondary market also make good sense.

As GBP plummeted and the FTSE faltered, wine investors here in the UK slept well, evidence below. Yet again wine demonstrates its enviable low correlation and low volatility characteristics when all around others were losing their heads. I’ll drink to that!

The WO 150 Index is GBP based, other indices are based in local currency.

Miles Davis, 5th October 2022

by Wine Owners

Posted on 2022-05-20

Just back from the USA where I spent two weeks speaking widely to wine business owners. There are signs of a cooling off in the fine wine market. Even given the buying power a strong dollar confers.

The backdrop is a correcting stock market that’s seen its biggest sell-off since 2020. Unlike 2020, the drivers behind the correction are inflation and the threat of recession. In other words, it’s not driven by a market discontinuity, however persistent Covid proved to be. It’s driven by a fear of market fundamentals turning sour.

As far as blue chip Bordeaux is concerned - as far as collectible fine wine in general is concerned - we don’t yet know the impact of these macro economic factors, nor the impact of a shock to global food security.

But I’d wager there are a fair few highly leveraged buyers, and a lot more feeling considerably poorer than a month or so ago. However immune much of that market may be to cost of living increases, it is not unaffected by sentiment.

The similarities between Spring 2020 and now are striking, albeit the outlook as of early summer 2022 is less positive because it’s harder to look beyond the events that are driving market concerns. Lockdowns drove outsized wine sales. A recession will not have the same effect. A well priced 2019 campaign lit up demand. An overpriced 2021 campaign could douse it.

Meantime arbitrage opportunities in back vintages abound, which is why négoces are busy buying UK stocks and why US fine wine businesses are buyers: but with what intensity and for how long?

by Wine Owners

Posted on 2022-02-03

As eagerly anticipated as the Sue Gray report, here it is, the annual WO round up and look ahead.

So, what happened?

2021 turned out to be a very good year for the wine market, the owners of wine and therefore for Wine Owners Ltd. also. Turnover on the exchange ramped up by 77% in 2021, producing more buying and selling opportunities than ever before! Our tenth year of trading is set to be an exciting one and has started well.

The broad based WO150 Index returned +15% with the stars of the show being Champagne and Burgundy, posting respectively +30% and +27%. Bordeaux returned a more modest 10% while Italy, having led the charge in 2020 came in with more modest numbers, yielding 6.5%. Tuscany performed better than Piedmont which was flat on the year. The Rhone did well, notching low double figures and the Rest of the World was twice as good as that, all thanks to California.

The reasons for the strength in the market were various; probably the biggest two were continued liquidity being pumped into the system in a low interest environment pushing more buyers into real assets, and the very real fear of inflation. Savings derived from staying at home more seems to have pushed up the spend on what people have been consuming at home – a quality driven drowning of sorrows in yet another lockdown!? The lifting of U.S. tariffs on some European wines brought a weight of new buying activity from across the pond, as did a lot of ‘new wave’ investment dollars - this should not be underestimated.

The market pre Covid had been largely stifled by various different factors but once demand started to outstrip supply, the market started to motor. Hong Kong and China were not responsible (for once) and collectively have been less of a force in recent times. Stringent lockdowns and border controls have meant very few visitors, especially of Mainland Chinese to Hong Kong, and an exodus of wealthy residents seeking a more liberated culture – some of the demand is moving elsewhere. Current thinking is that will last for some time (not just until after the Winter Olympics!), so be warned. I would expect Singapore to take up some of the slack and become a more prominent player.

Champagne

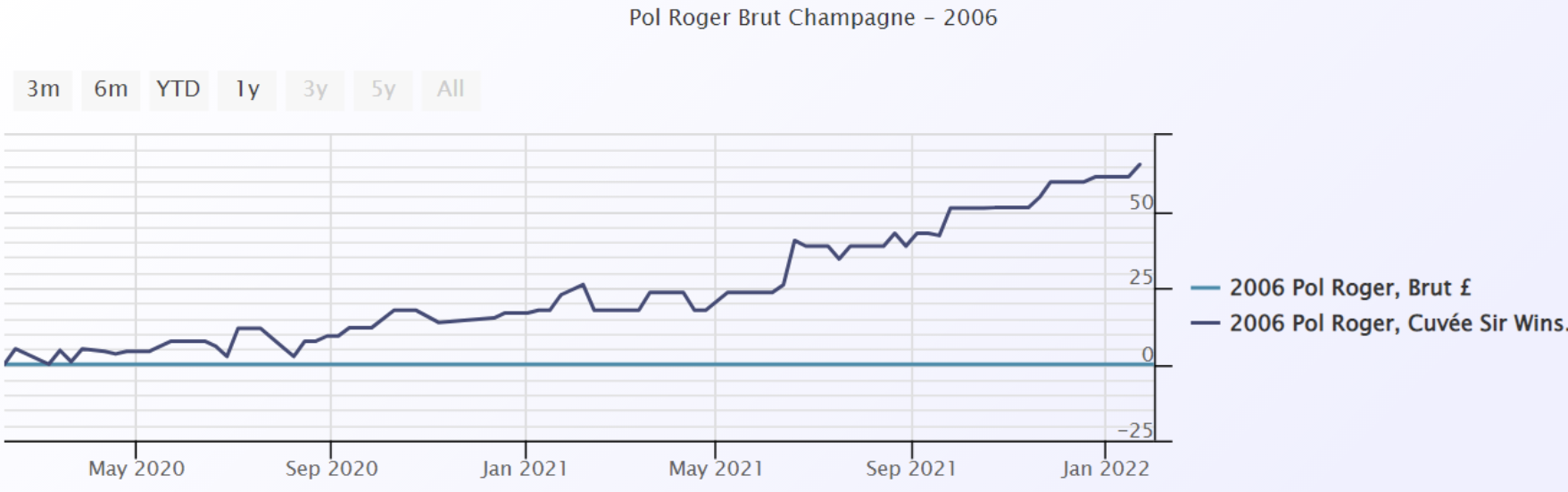

I cannot remember Champagne ever being the star turn in the wine market before but given the cyclical nature of the market and the fact that the different regions are much more equal than they used to be, it is not surprising. It has also consistently delivered steady returns, see my report from last July, just before the market really accelerated. Reports of supply shortages coming out of the region and a slew of really good quality releases added further weight to the concept of Champagne as an investment proposition which led to some voracious buying activity. The Champagne Index is dominated by the biggest names and/or the tête de cuvée of noble producers. As ever, fine wine collectors and investors focus in on the most prized assets driving the gap between the seriously good and the seriously a little bit better than that ever wider. Here’s a good example, vintage Pol Roger ’06 versus the Sir Winston Churchill cuvée from the same year:

The ‘simple’ vintage Champagnes from good producers offer extremely good value to drinkers and is a segment of the market that has been left behind.

Where Champagne goes from here is one of the big questions as some of the recent returns have been enormous. Various vintages of Krug, Dom Perignon, Taittinger’s Comtes de Champagne, Pol Roger’s Winston Churchill have added more 50-100% in the last year and rosé Champagne has been bought in a way not seen before. I am tempted to take some profit from some of the biggest risers and look for some laggards.

Burgundy

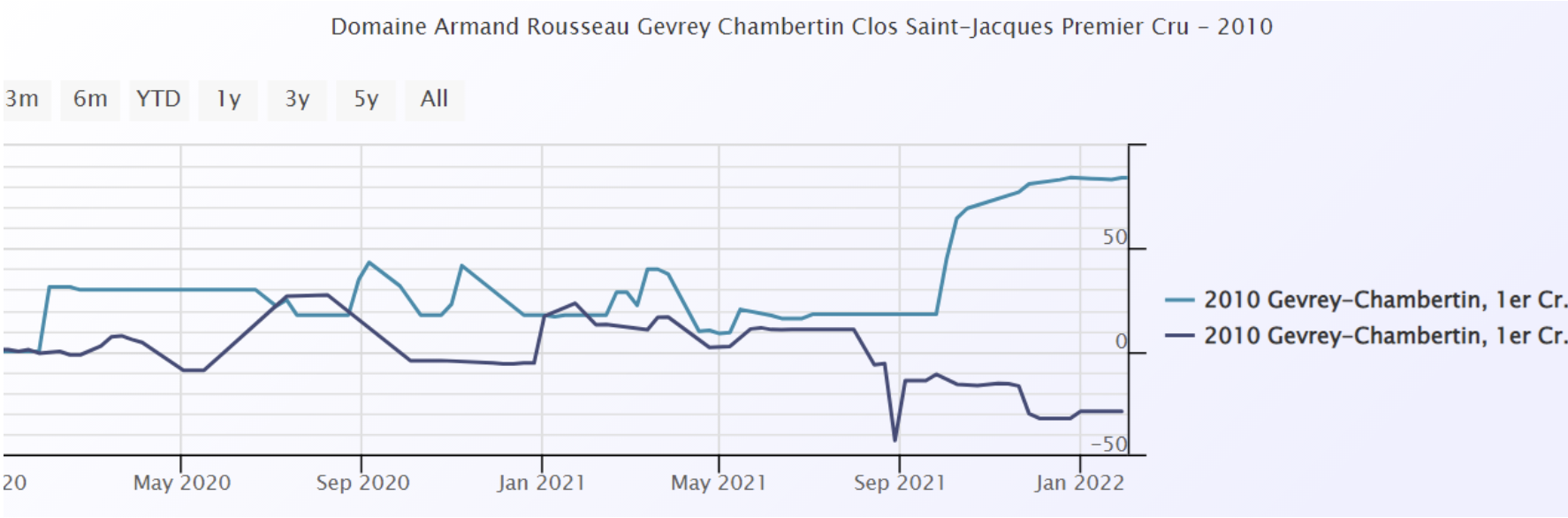

The polarisation of the wine market and the premiums attached to the most desirable names have continued to grow and probably make less sense than ever before. Names such as Leroy, DRC and Rousseau in Burgundy have outperformed their neighbours and as highlighted in some of our recent offers, often trade at multiples of equally high scoring wines from the same vineyards but from less famous producers. Obviously, this creates opportunity and I feel more comfortable making bets at the prices that are a fraction of the big guys. Here is a comparison between Armand Rousseau’s Clos St. Jacques (light blue) versus Bruno Clair’s. This sort of chart can be repeated numerous times - premiums have become too large for my liking, but if Rousseau is your man and you have the cash….

The current shortage of 2020 red Burgundy and the general short supply frost hit ’21 vintage, see report from last November, will push prices and demand ever higher and whilst some price performances seem overly vertiginous, I anticipate they will continue their path – for now at least. High rollers love spending big on Burgundy and the small production levels really adds the glitter dust to this famous region. And there are always the producers that are beginning to make a name for themselves.

Bordeaux

Bordeaux had a decent year, posting +10%. Apart from a brief flirtation with the 2019 en primeur release, Bordeaux has not been sexy for a very long time now. Market share continues to fall as other regions eat into the Bordelais’ gateau. It is still, and always will be, the largest slice of the market and those who buy into the general wine argument and need liquidity are best allocating here. It has become the steady Eddie. As a massive generalisation you know what you’re getting in your glass with a Bordeaux; a lot of that infuriating yet bewitching and beguiling wonder of what to expect from your wine just doesn’t exist in the same way that it does with Burgundian Pinot or Piedmont’s Nebbiolo and passionate collectors are just not quite so aroused by its charms (as I said, a generalisation!). I expect it to remain firm however.

Italy

Italy has had a mixed year. Super Tuscany has done well, the massive names of Sassicaia, Tignanello and Masseto have continued to shine posting average gains in the region of 25%, 35% and 25% respectively, and Solaia and Ornellaia also, but not so brightly. Lots of smaller Brunelli have fared quite well and this sector continues to build – hardly surprising given the price to quality ratio. Piedmont has had a mixed time, Monfortino in general is up a little in most vintages but lots of big names across the region have remained unchanged. I would not be surprised to see interest return to this area once Burgundy’s current run has blown through. There are still numerous 2016s looking very interesting for the longer term.

The Rhone

The Rhone valley is more appreciated than ever before. There are numerous cult producers all over Cote Rotie, Hermitage, Cornas with St. Joseph coming to the party nowadays. Prices of Rayas product from down south have travelled to the far north as collectors chase these rare treasures. White Rhone is still very much a speciality interest but one to keep an eye on. I have bought a lot of red Rhone for drinking from the WO platform in the last year or so as the combination of maturity, quality and price is virtually impossible to beat. There are plenty of names delivering superior returns too.

The Rest of the World

California has dominated the remaining regions with some ease, posting over 20%. Screaming Eagle has led the pack, followed by Ridge and Dominus. Australia has suffered at the hands of China’s tariffs.

Conclusion

I am confident the market will continue to perform well this year. Sentiment is strong, and supply in some key areas is shorter than usual, especially Burgundy. The inflation fear mentioned earlier is real and wine has been seen as a good hedge against this for a long time now. Interest rates are likely to rise but remain historically low and the real asset argument holds sway but will lessen as QE reverses – something to keep an eye on. Access to the fine wine market is greater than ever before, particularly in the U.S., and continues to grow.

As ever, I would be delighted to hear from you to discuss any of this, or anything else wine related. I am happy to help and advise on your portfolio or cellar, for investment or drinking purposes. And now we can go out again I would be delighted to share a bottle!

Miles Davis 02/02/2022

by Wine Owners

Posted on 2020-12-09

Miles Davis, Wine Owners December 2020

As we head into the final phase of this extraordinary year, the world of wine investment is a calm and beautiful little side water, gently ebbing and flowing with that serene feeling it knows where it is going.Traditional assets continue to bounce around, no doubt causing palpitations and stress. More than ever, this year has been about timing in the capital markets, and if you got that wrong, the chances are you got it expensively wrong. Not so for vino! Unlike after the global financial crisis, the wine market has held its nerve, merchants did not mark down prices and the market has been stable. Investors are about, and even Bordeaux prices feel like they are firming up. Collectible assets are in vogue and it is easy to see why given these circumstances. You cannot even hold, let alone drink, a bitcoin, a share, a derivative, an option or a future and a bottle feels good, especially in lockdown!

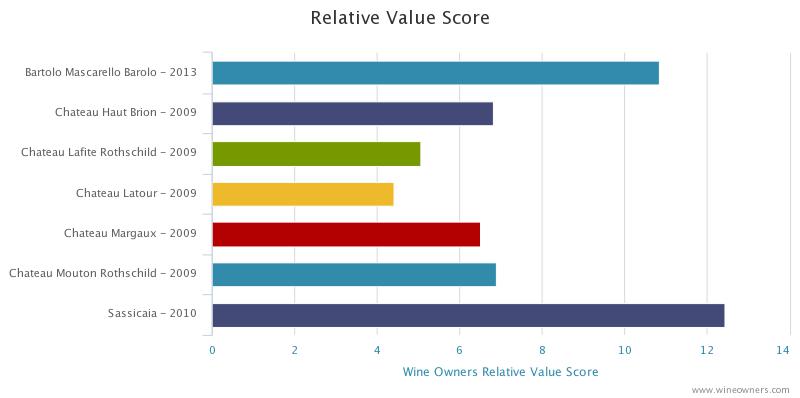

Demand from Asia has increased and merchants trading the big names have been pleased with activity levels in recent weeks. There is almost a feeling there is an element of restocking going on after a quieter than usual period (in Asia) over the preceding months. This has happened in a period when the currency has gone against dollar buyers, although only marginally. Buying is very specific but certain names have moved up considerably since the middle of the year, Mouton ’09 and ’10, for example, are both up c.10%, the controversial ’03 c.14%. There does not appear to be any thematic buying, however, so it is not possible to call a vintage, or a certain Chateau or producer. Keep looking for the relative value is my suggestion and do not forget to make use of the useful tools we provide. See below for an example (if anyone would like a demo on how to use this, please ask):

In Burgundy, especially in the trophy sector, if it is not in its original packaging it is not going anywhere and vice versa. We have seen big ticket items in Leroy and Cathiard sell well recently. Provenance is key and is proving valuable.

Piedmont, Super Tuscans and Champagne remain firm, as does my conviction as areas for further purchasing.

We have had a lot of demand for Penfolds products; whether that continues given the newly slapped Chinese tax on Aussie wine imports will be interesting to observe but, in the meantime, we have plenty of two-way activity.

Personally, I have never been able to compute the prices of some of the ‘Cult Californian’ wines but, in fairness, I have rarely tasted them. Not so for that wonderful producer that is Ridge; the wines are lovely and the prices reasonable, in normal fine wine language, and a total give away compared to some of the ‘cult’ counterparts. We have offers of the flagship, Monte Bello, on the platform of the ’10, ’13 and ’17 that I would happily recommend, to anyone!

**************************

We have been busy at Wine Owners, with a lot more trades going through, spread amongst an ever-increasing group of followers. We are at record levels of new subscribers and have £300k of fresh offers in the last week alone. Notwithstanding the difficulties of some warehouse operations presented, our back office is working well, and our post trade analytics improve all the time.

On that bullish note, the team and I would like to thank everyone for their ongoing support. For those who have not yet fully engaged, we look forward to welcoming you soon.

Have a very happy Christmas, a wonderful new year, and drink as well as you can!

Miles Davis, 8th December 2020

by Wine Owners

Posted on 2020-11-12

Miles Davis, Wine Owners November 2020

There is not much to report on for October. The market continues to be very steady, gently rising in fact, and lacking in volatility – we are leaving that for the traditional asset classes and for those with a strong constitution!

The Covid related news had been sending shivers down the spines of stock markets as we here in the UK were heading into our second full lockdown of the year, only for that to turn around swiftly on the good news on vaccines.

The platform was busy in October, however, with good demand from Asia. Bordeaux indices have even been positive although overall market share remains weak. Sterling had been a little weaker during the month and this normally speedily converts into demand for Bordeaux blue chips from Asia. We have seen continued demand for Italian wines and Champagne with red Burgundy more mixed. Top end white Burgundy priced sensibly soon disappears from the platform and liquidity in this sector is perhaps stronger than it has ever been.

Champagne is the focus of the month and there could even be unprecedented Christmas demand this year if lockdowns ease and families and friends are once again allowed to socialise!

The recent release of Taittinger’s Comtes de Champagne 2008, which receives a fabulous write up from William Kelley of the Wine Advocate and 98 points, was met with great interest. There’s plenty of supply right now but given time there is plenty of room for price upside given the level of the ’02 now. Here is the relative value chart:

Obviously ’06 is the cheapest here but that, nor the ’04 vintage, quite carries the same stature of the fabulous ’02 and ’08 vintages. Having said that and given the quality of the juice we are talking about, Relative Value Scores at 30 or above look good in any book!

Generally speaking, I like the lower production levels of Pol Roger’s Winston Churchill Cuvée. In fine wine terms, Dom Perignon and Cristal produce vast quantities but are truly international brands and therefore trade at premiums to other names. Comtes falls somewhere in between.

Here are some price and point comparisons of the names discussed here, from really good to excellent vintages.

Overall, I would not put anybody off buying these wonderful wines for the medium to long term, they have years of life ahead and plenty of upside potential as they become rarer and rarer – and more golden!

|

| | Vintage | Price | WA Score | Price/Point (WA) | VINOUS Score | Price/Point (VINOUS) |

| Dom Perignon Champagne | 2002 | £127 | 96 | 1.32 | 97 | 1.31 |

| Dom Perignon Champagne | 2004 | £107 | 92 | 1.16 | 95 | 1.13 |

| Dom Perignon Champagne | 2006 | £108 | 96 | 1.13 | 95 | 1.14 |

| Dom Perignon Champagne | 2008 | £110 | 95.5 | 1.15 | 98 | 1.12 |

| | | | | | | |

| Louis Roederer Cristal Brut | 2002 | £213 | 98 | 2.17 | 94 | 2.27 |

| Louis Roederer Cristal Brut | 2004 | £160 | 97 | 1.65 | 96 | 1.67 |

| Louis Roederer Cristal Brut | 2006 | £130 | 95 | 1.37 | 95 | 1.37 |

| Louis Roederer Cristal Brut | 2008 | £158 | 97 | 1.63 | 98 | 1.61 |

| | | | | | | |

| Pol Roger Cuvee Sir Winston Churchill | 2002 | £167 | 96 | 1.74 | 96 | 1.74 |

| Pol Roger Cuvee Sir Winston Churchill | 2004 | £127 | 95.5 | 1.33 | 93 | 1.37 |

| Pol Roger Cuvee Sir Winston Churchill | 2006 | £117 | 95 | 1.23 | 96 | 1.22 |

| Pol Roger Cuvee Sir Winston Churchill | 2008 | £140 | 97 | 1.44 | 95.5 | 1.47 |

| | | | | | | |

| Taittinger Comtes Champagne Blanc de Blancs | 2002 | £166 | 98 | 1.7 | 97 | 1.71 |

| Taittinger Comtes Champagne Blanc de Blancs | 2004 | £96 | 96 | 1 | 96 | 1 |

| Taittinger Comtes Champagne Blanc de Blancs | 2006 | £73 | 96 | 0.76 | 95 | 0.77 |

| Taittinger Comtes Champagne Blanc de Blancs | 2008 | £117 | 98 | 1.19 | 96 | 1.22 |

by Wine Owners

Posted on 2020-10-06

Miles Davis, October 2020.

7min read.

Given the lack of relatively significant news in the wine market, this is the first report since early in the second quarter of the year.

In fact, it is fair to say that the world of fine wine has been relatively boring, and in this world, boring is good! The lack of volatility has been impressive. The WO 150 index has (rather surprisingly) posted a gain of c.%5 this year but that should come with the caveat that the constituents are older vintages and not the most liquid.

In the aftermath of the 2008 financial crisis, the major wine indices (predominantly Bordeaux led) fell sharply (c.25%) as market players and stockholders marked down prices, desperately trying to reduce inventory. The relative newcomer, China, was busy buying all the Bordeaux it could at the time and was presumably a little surprised by this sudden easing of prices – after all, what did wine have to do with the financial markets??

Anyway, Bordeaux prices rebounded quickly and from early 2009 to mid- 2011 witnessed one of the biggest rises in prices this market has ever seen, followed by a sustained bull run for, the recently discovered by China, red Burgundy. Unlike 2008, the Covid-19 infested world of 2020 is yet to lead to a global banking crisis, but the economic effects will surely be felt for some time and some easing of prices would not be surprising; yet in the world of fine wine prices are not being marked down, and the indices are largely flat. There is no panic and this is good. As you would expect, liquidity isn’t great, spreads are wider, and there aren’t many merchants buying for stock. Overall, the volume of wine (number of bottles) traded has increased although there are widespread reports of the value being lower – hardly surprising.

Here’s the WO 150 vs. the FTSE in the last ten years:

Other than a reasonably successful 2019 en primeur campaign, of which more later, Bordeaux has maintained its trend of recent years - its market share continues to slide. In August it hit a new all-time low of 35%, according to our friends at Liv-ex. Ten years ago that number was 95%! It is still easily the most liquid market, however, and that should not be forgotten in times of stress. Lafite and Mouton Rothschild still dominate Asian demand but long gone are the days when the prices just kept on rising; they are flat.

The 2019 Bordeaux en primeur campaign was highly unusual, in many respects. Not only did it happen in lockdown, it happened, apart from the locals, without any but the top wine journalists tasting any of the wines – unheard of! We decided to listen more to Jane Anson (Decanter) and James Lawther (jancisrobinson.com), both based locally, than other international critics after reports of samples being abandoned on melting driveways and being flown around the world in a rush; it just seemed more prudent. The consensus, however, or whatever, was that it was another fabulous vintage and even came out with the highest average scores in fifteen years – no mean feat. The other strange thing that happened was that some Chateaux priced the wine attractively. Prices needed to be 20-30% below 2018 prices to sell through and some were. The leading names for relative value and quality were the Lafite (including L’Evangile) and Mouton stables, Pontet Canet, Palmer, Canon and Rauzan Segla. The campaign came as a much-needed boost to Bordeaux’s flailing reputation, but it took some extreme circumstances to bring it about. In terms of wine, Bordeaux is doing nothing wrong, it is the pricing that is the issue.

The super-fabulous-amazing 2016 Piedmont vintage has been dribbling into the market, some via the grey market European trade and some from agent releases. Given the general mood, these have been easier to accumulate than in a non-virus savaged world and without an organised primeur release. Who knows how well these wines would sell if you had all the merchants shouting their virtues from the rooftops at the same time? Three wines, all with 98 points from Monica Larner that make sense and that I have bought are: Cavallotto Bricco Boschis (£260 per 6), Elio Grasso Gavarini Chiniera (£375) and G.D. Vajra Bricco delle Viole (£360). Luciano Sandrone’s Le Vigne 2016 was awarded the magical three-digit score (ML also) which sent the price from c. £550 to £1,250 before settling at around £1,100 now. From the same estate, Aleste (formerly Cannubi Boschis), with a mere 98 points, makes sense at £650. The official U.K. release from Roberto Conterno will be in October and although they are not yet scored, I have been accumulating in the grey market. They have decided not to make Monfortino in ’16 as it’s not the right style (!!??), which can only leave Cascina Francia as one of the buys of the decade, but what do I know?

As readers know, I am a keen fan of Italian wines for the portfolio, particularly Piedmont and Tuscany and wines from here can easily take greater supporting roles. The lead roles of Bordeaux and Burgundy have never felt more questioned. Super Tuscans are well developed in terms of the market and continue to do well, other Tuscan wines to a lesser degree. 2015 and 2016 were epic years in Tuscany, as we already know, but the ‘16 releases of Brunello are still to come and there will be opportunities ahead.

This interplays with the theme of new areas becoming more accessible and more interesting. The rise of the new world continues gradually as the depth of this market grows. Wine knowledge is on the up, price transparency and trading channels are ever more abundant, so competition from other areas is bound to increase. Quality from everywhere is on the up and the international market is flourishing.

The Champagne market deserves more on the limelight too. Here is the ten-year chart of the WO Champagne 60 index, a smooth 9% annualised, with barely a bump in the road:

Burgundy is in a funny place right now. The froth has definitely been blown off the top end of the market, even before the pandemic struck and the usual suspects do not just fly out of the door anymore. There is still demand for DRC, but it needs to be in OWC. Buying is to order, not for stock, and prices need to be sharp to attain a sale. The performance of collectable white Burgundies has been greater than their red counterparts recently and this is a very interesting area. Buy top quality producers at an early stage and do not hold on too long – the fear of premox has not disappeared entirely!

Keep an eye out for South African wines, mainly for the drinking cellar at the moment, but quality and media coverage are on the rise.

Any questions, please let me know.

Good drinking!

Miles

by Wine Owners

Posted on 2020-05-20

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair.” Charles Dickens.

18th May 2020 kicks off the Bordeaux 2019 en primeur campaign with the release of Chateau Angludet. They’ve partially gone down the amphora route to gain purity. It’s a great success, a very great Angludet, according to a number of merchant emails received today. Those same emails belie one small issue - that the wine has yet to be tasted. A reminder of the impact of Covid-19, the anxieties and emotions over this year’s releases dominated by hope and despair. So we have to take the Bordelais at their word that it’s a great vintage, fresher than 2018, in the same mould as 2016 or 2010. I’m sure producers are excited by what they have in cask or tank or whatever receptacle the juice is in these days. But it’s not unjustified to say that local opinion isn’t always entirely objective. So bring on those Chronopost and UPS samples and let us all taste...

We have to be honest, we’d have much preferred a deferral of the campaign to October after the harvest. We don’t agree that would have caused any issues with other regions’ releases. There is something very strange about releasing a futures campaign whilst so much of our economy is in deep purdah. But the die has been cast and June it is (for the 60-odd releases that the market chooses to focus on).

The choice of timing of the releases is significant. It is quite obvious that, just like the 2008 vintage release, there will have to be a very significant reduction in release prices for 2019 to find a market. Those properties who have tended to use en primeur more as a marketing opportunity than a selling one will have to think about what it means to them: the prospect of a marketing campaign has more or less evaporated. For those properties who expect or need to sell a sizeable percentage of the harvest, only one one of the four marketing ‘P’s matter. It can be the best vintage in the world, it can garner (in the fullness of time) more 100 pointers than any of the last 40 years, but success will boil down to one thing and one thing only: price.

That decision will have ramifications on the whole of the Bordeaux global secondary market. A significant reduction of 30%-40% can ignite interest in the region’s great wines. It can draw in a new generation that has largely ignored the region, or doesn’t see the point of purchasing new releases two years before shipping. It can reward buyers of the last vintages who are under water and likely to remain so. A compromise that shows intent but brings us back to the levels of 2015 will consign Bordeaux to another year in the shallow quicksands of a secondary market lacking direction, fearful of the future, unwilling to commit cash, failing to see the point anymore.

Ah, I hear you say, but the world is awash with cash desperately looking for a home, just as it was post-Lehmann - when the fine wine market benefitted royally. I disagree. We are entering uncharted waters and cash in the bank trumps FOMO, the fear of missing out. Warren Buffet can be wrong sometimes, but not all the time, and moving to an underinvested position does not seem completely crazy.

So let’s say that 2019 is the equal of 2016, increasingly recognised as the greatest classic Bordeaux vintage in a generation. 2019 is likely not its older sibling’s equal (probably, but who knows) but let’s pretend it is for a second. Even on this most optimistic reading of the new vintage, would you rather buy into a vintage that has been tasted, re-tasted, evaluated ad infinitum and has withstood the scrutiny of the entire market, or roll the dice with a vintage that will be narrowly evaluated based on posted samples? Add to that 2016 prices that have barely moved or drifted down, and the comparative case for 2016 is about as strong as it gets.

Bring on June, and a prediction: either the most successful en primeur campaign since 2016 (notwithstanding Covid-19) or a non-event, determined purely by one variable - price.

Nick Martin

20th May 2020

by Wine Owners

Posted on 2020-05-19

Miles Davis, 18th May 2020.

Activity in the wine market in April was, pretty much, a repeat of what we saw in March. Numbers of alcohol and wine sales have been higher across the board since the pandemic struck, with people apparently drinking more, just less publicly! Closer examination would suggest quantity is winning out over quality, as volumes are up but values are lower. This comes as little surprise and this trend has been replicated on the Wine Owners platform. Plenty of gluggers being bought with little activity in the investment grade.

One interesting area of note amongst London’s fine wine traders, who have generally been quieter than in more normal times, has been a few very high value trades purchased by drinkers not investors. High value cases of DRC, Le Pin and other very top end names have been changing hands in piece meal fashion. Otherwise trade stumbles along with consumers rather than investors calling the shots.

The trends that existed pre the virus seem to be continuing and there is no question Italy continues to steal the limelight away from France. There is no doubt the lack of U.S. tariffs on Italian wines will be assisting here but Italy is on fire anyway. Some superb vintages from their finest wine regions, namely Piedmont (2016) and Tuscany (2015 and 2016) are proving popular amongst wine lovers who are accustomed to paying far more for their French equivalents. These wines are coming to the market now as the Italians release their wines much later than the French. The extra ageing that occurs helps enormously as the reputation of the vintage is not speculative; the wines will have been tasted and re-tasted, so that significant element of risk is eliminated. They don’t ‘do’ en primeur like the French either, so there is far less hype and less FOMO (fear of missing out), so all in all it’s better for the purchaser (the two countries really could learn quite a lot from each other!). Chateau Angludet released their 2019 yesterday, even though only a handful of people have tasted it, as the whole Bordeaux en primeur system challenges itself yet further. June is the current plan for the pricing up of Bordeaux primeurs and unless there are substantial price reductions, we must surely be looking more at a case of double amputation rather than simply shooting one’s own foot off!

Whatever happens with Bordeaux en primeur I strongly believe Italy and the rest of the world will continue to eat into the French gateau. The fine wine market continues to broaden, there has never been so much good wine coming out of other regions and other countries, with journalist’s coverage to match, and with points awarded to even outstrip that! The economic effects of Covid-19 are going to be felt far and wide and the quest for relative vinous value will be evermore sought after.

miles.davis@wineowners.com

by Wine Owners

Posted on 2020-04-08

Miles Davis, 2nd April 2020.

If we look at the performance of the wine market relative to the major asset classes, wine has, once again, demonstrated some fine defensive qualities. The wider wine market has traded in a narrow range in the last couple of years, but the WO 150 is still up 57% over a five-year period. So far this year the WO150 is -1.3%. The WO First Growth 75 Index is down 6.6% - not bad compared to the FTSE slide of over 26% (peaking at -34%). There is a correlation in that the Covid 19 crisis has brought both classes down but the difference in magnitude and the speed in which it happens is significant:

Perhaps there will be a time lag response to the wine market as liquidity is so relatively small and because professional investors will not even stop to think about wine in times such as these (a good thing!). Following the Global Financial Crisis in 2008, The Fine Wine Fund, which I was co-managing and invested entirely in blue chip Bordeaux, lost an average 5.5% a month between September and December.

| Wine |

Current Value |

MTD |

YTD |

1 Year |

5 Year |

10 Year |

| WO 150 Index |

306.56 |

2.00% |

-1.52% |

-0.26% |

54.19% |

83.43% |

| WO Champagne 60 Index |

488.78 |

2.24% |

1.73% |

6.53% |

62.87% |

151.71% |

| WO Burgundy 80 Index |

786 |

5.20% |

7.57% |

17.87% |

155.27% |

256.58% |

| WO First Growth 75 Index |

251.92 |

-0.29% |

-7.14% |

-9.68% |

34.15% |

46.01% |

| WO Bordeaux 750 Index |

365.35 |

2.71% |

0.08% |

8.06% |

68.39% |

105.06% |

| WO California 85 index |

685.88 |

1.42% |

0.04% |

2.46% |

94.94% |

292.25% |

| WO Piedmont 60 Index |

312.96 |

2.44% |

-5.89% |

-2.24% |

68.28% |

101.01% |

| WO Tuscany 80 Index |

339.75 |

2.33% |

5.82% |

15.45% |

77.51% |

96.32% |

So far, the current market does not feel like it is going to react in quite the same way as either back then or like the major asset classes. To start with Hong Kong (and therefore China) has been inactive for the last nine months, first with the political troubles and now the virus and inventory must have reduced but, more importantly, the strength of the US dollar versus sterling is in play. At the start of the year GBP/USD was 1.33, falling to 1.15 on the 20th March and now at c. 1.24. The depreciation of GBP has protected sterling holders of wine and encouraged dollar buyers back into the market – indeed, we have seen this as a noticeable trading pattern, one which will probably continue.

Our own experience is that we have seen buyers of first growth Bordeaux, village and premier cru Burgundy, 2016 Piedmont and some of the super Tuscans. Most of the sub-indices are in good shape but there are two points to note here; one is that merchants rarely mark stock down unless they have to and the other is that these are calculated using the only readily available price – the offer price. Bids may well tell a different story.

Overall, the wine market is going to struggle this year and I would predict mainline prices, i.e. liquid Bordeaux and expensive Burgundy will be up against it. There will be lots of opportunities however and I do not expect a sudden crash, as we would have seen that by now. In a normal market 2016 Piedmont would have been extremely difficult to buy but, as it is, it is proving a joy. This will not be the case when the dust settles and as there’s very little to go around, I repeat my buy recommendation.

N.B. Our Burgundy index needs reworking as it has too many older, illiquid vintages contained within it.

by Wine Owners

Posted on 2020-03-17

We live in extraordinary times and what we thought was the perfect storm for the wine market just became a lot more perfect! Since I last wrote, major asset classes have tumbled in value as fear and uncertainty grips the globe. Wine prices look like they have barely moved in comparison to equity indices and the like but the reality of achieved selling prices would tell a different story. This is the nature of illiquid markets.

We have all lived through market crashes before and experience tells us that the aftermath makes for a very good buying opportunity. Admittedly we haven’t had an economic downturn brought about by a pandemic before. We don’t know how long the pandemic will last and how deep the economic hit will be.

We haven’t seen panic in the wine markets, not yet at least, and it’s fair to say that it feels like Hong Kong is waking up a little, in an almost post hibernation sort of way. Comment from friends in Hong Kong gives the impression of calm and that the worst is over. Although social distancing is still in full force people are getting on with the rest of their lives. Given how inactive, wine-wise, that area has been since last July, it’s possible that inventory needs restocking. Political unrest has also been dampened by the virus, so maybe there’s some cause for some springtime optimism in the orient.

Sadly, events in Europe and the west are only likely to deteriorate before they improve. The UGC finally called off Bordeaux en primeur tastings last week. My personal view is that this is a fantastic opportunity to reorganise tastings later in the calendar, giving the infantile wines a chance to develop and settle. The volatility of the major markets should have settled by then as well, inspiring better judged pricing.

Keep well, don’t panic and for those with cash, there will be some lovely opportunities. The Warren Buffets of the wine world will be rubbing their hands in glee!

| Index | Value | MTD | YTD | 1 Year | 5 Year | 10 Year |

| WO Burgundy 80 Index | 747.18 | 1.42% | 2.26% | 6.44% | 142.30% | 238.96% |

| WO Bordeaux 750 Index | 355.72 | -2.99% | -2.55% | 5.97% | 68.01% | 99.65% |

| WO Piedmont 60 Index | 305.5 | -8.39% | -8.13% | -5.73% | 64.89% | 96.22% |

| WO Tuscany 80 Index | 332.03 | 1.75% | 3.42% | 12.73% | 71.79% | 91.86% |

| WO First Growth 75 Index | 252.65 | -6.02% | -6.87% | -7.45% | 36.40% | 46.43% |

| WO California 85 index | 676.29 | -4.38% | -1.36% | 2.15% | 94.66% | 286.76% |

| WO Champagne 60 Index | 478.07 | -0.04% | -0.50% | 3.85% | 60.56% | 146.20% |

| WO 150 Index | 300.54 | -3.60% | -3.45% | -2.42% | 54.98% | 79.82% |

Miles Davis, Wine Owners March 2020