by Wine Owners

Posted on 2018-04-12

A late return tonight (past midnight) and a long day, waking at 05:00. But there's still gas left in the tank, so to speak. Over the course of the day we gathered thoughts in advance for the below.

Saint-Julien Delivers

JR has been looking for patterns all week - some form of shape around which to build recommendations for wise en primeur purchases. Until this afternoon we failed to find anything solid, but then...Saint-Julien delivered. At the UGC (Union des Grands Crus) Saint-Julien tasting hosted by Chateau Beychevelle at its modern-looking new winery, we noticed a clear consistency in the wines; there wasn't a dud among them. Well, maybe there was one, but we don't need to talk about that as it wasn't really that bad. Either way, this was the first appellation we'd seen where quality was reliably high in these en primeur tastings. Everywhere else had required dedicated tasting to work out what was hot and what was not. So thank you Saint-Julien, and bravo!

Bright Whites

Of course, as soon as this pattern had been spotted, we remembered another that we wanted to talk about yesterday(but ran out of time). It's the incredible purity to the whites this year, all around Bordeaux - not just in Graves where we were today (starting with Haut-Brion, Pape Clement and Smith Haut-Lafitte) but everywhere. Lovely balanced wines great concentration and acidity, and pithy, chalky tannins. Our tasting notes are full of descriptors like kaffir lime leaves, sweet sage, gooseberry, sherbet and candied lemon. Even lemon verbena made it in there. 2017 looks like a really great year for Bordeaux whites.

©Nick Martin / Wine Owners

The Cold Shoulder

Frost - the running theme of conversations all around Bordeaux this week - was as much as issue in Graves as it was in the right bank. The frost pattern here in the Graves seems to have been much more black and white than over in Saint-Emilion and Pomerol. For some producers, there is a glittering silver lining to this rather painful situation, in that they adapted to it by significantly changing their blend and have come out smiling. Larrivet Haut-Brion is a gleaming example of this; the team there turned their blend around to use three times the usual amount of Cabernet Franc, and one third the amount of Merlot (which got severely hit by the frost). Les Carmes de Haut Brion is a similar story, and a similar success.

We have been focusing a lot on the frost topic (both here in the blog, and in our conversations with producers), but in fact a key point we'd like to make is that the frost is not something that consumers and investors should really focus on. What really matters, ultimately, is what each of the producers has managed to create. There are no strong patterns that consumers can reliably follow with regard to the frost.

Softly Softly Catchy Monkey

After a morning on the right bank, we returned to the Medoc, to the UGC tasting at Lafon Rochet. There, Basil Tesseron told us that 2017 was a vintage where it was extremely important not to over-extract, not being a super-ripe or sunny vintage. Over-extraction would just lead to mean, green bitter compounds leaching into the wine. This echoed a sentiment raised earlier in the day at Smith Haut-Lafitte, where the team did 4 pigeages per day, but no pumperovers, in order to keep the winemaking relatively gentle. 2017 was a year to be patient for picking and gentle in the winery.

©Jonathan Reeve / Wine Owners

Less (Wine) Does Not Necessarily Mean More (Money)

Despite indications given by some chateaux that smaller harvests will mean higher release prices, we see no justification for this. Traditionally, in vintages which are not 'stellar' -particularly those which followed relatively good vintages (as 2016 was) vintages, prices have tended to drop or remain roughly stable. Even in 2006 prices didn't significantly rise; they stayed roughly the same as 2005 even though the vintage clearly wasn't quite as impressive.

Tomorrow is a final look at the top producers we've not yet visited, all around the region. Lots of driving, between Le Pin, Angelus, La Conseillante, Eglise-Clinet and then back over the river to Latour, Leoville Barton and Palmer. Here's hoping for good driving conditions!

by Wine Owners

Posted on 2015-05-27

So goes the good luck saying, advising what a bride might wear at her wedding to bring good fortune.

In reviewing Bordeaux 2014 releases to date what could be more appropriate? After all, this has been a campaign where a few enlightened producers got their winemaking and pricing aligned, whilst others (the majority?) have simply ignored the current compelling pricing of many of their back vintages of comparable quality.

In the light of that, what mixture of old and new vintages might the wine lover or collector consider?

SOMETHING OLD

Something old is symbolic of continuity.

When comparing the 2014s to broadly comparable back vintages, it reaffirms the value there is in wines around the 7-12 year old mark. In the majority of cases these are wines just hitting their stride, and in some cases with enormous drinking windows ahead of them.

Here are some examples but today Bordeaux unquestionably is generally favouring back vintages over new releases.

L’Eglise Clinet 2006

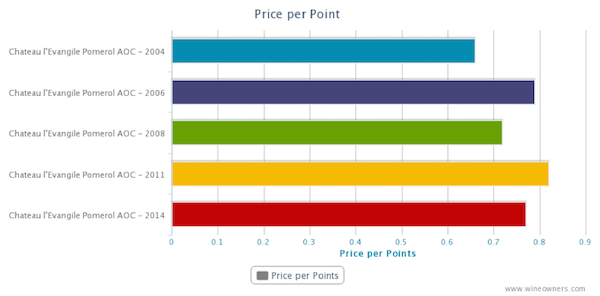

I just love L’Eglise Clinet, so I’m delighted to give it my first mention. Only, why buy 2014 when 2004, 2006 and 2008 are all cheaper? Personally I’d probably pay the market premium for the 2006, simply because that vintage is proving to be such a fine year in Pomerol. There is so much definition to the fruit, and such balance to the best wines. L’Eglise Clinet is an obvious choice due to winemaking of the highest order over the last decade.

Haut Brion 2008

At around £2,400 per case, the 2008 makes a profoundly compelling case for itself, as does the 2012 in the light of its recent Parker rerating, reinforced by other reviewers such as Jeff Leve. Throw 2006 into the mix as a wine of exceptional purity, and there’s an embarasse de richesses for grown up lovers of Graves.

Palmer 2004

Leaving aside the fact that the beautiful 2014 is Palmer’s first vintage made entirely biodynamically, 2004 still stands out as a wine value that warrants the wine lover’s attention. According to Parker it’s a modern day version of Palmer’s brilliant 1966, majoring on elegance and precision, freshness and depth of flavor.

SOMETHING NEW

Represents good luck, success and hopes for a bright future.

Let’s start with a handful of winners. Using the soon to be released price per points analysis feature on Wine Owners highlights value in the context of broadly comparable quality. The teetering Euro helped, creating a rare opportunity for Châteaux to please the market and satisfy their accountants. A handful grasped the opportunity.

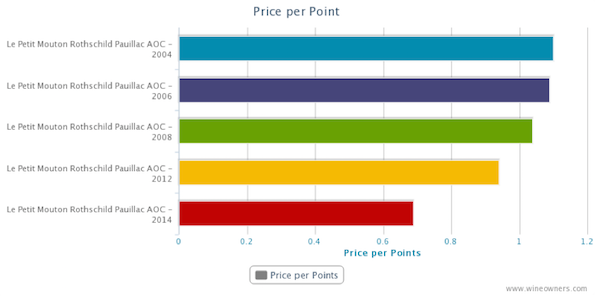

Le Petit Mouton 2014

Growing positive sentiment in respect of the quality of the last decade’s vintages has given those years a recent helping hand. This is the cheapest vintage in the market at £375, and a 40% discount to its possible qualitative equal – 2006. Different too. The success of Merlot on gravel relegated a big slug of Cabernet to the second wine, so atypically cabernet-dominated and correspondingly serious.

Mouton Rothschild 2014

Outstanding in a vintage in which Pauillac starred. There’s a breezy balance whilst its Merlot genes and dash of Cabernet Franc complete a raspberry-driven, fresh, complex palate with plenty of fine-grained tannins. They got the price right as the charts show.

Lynch Bages 2014

Poised, with classic Pauillac character; loaded with griottes fruit and flowing Saville Row lines. It was priced to within a hairs-breadth of 2011 and 2012 current market value but the value difference over 2008 and 2006 must have convinced loyal buyers to part with their money early as merchants reported healthy demand.

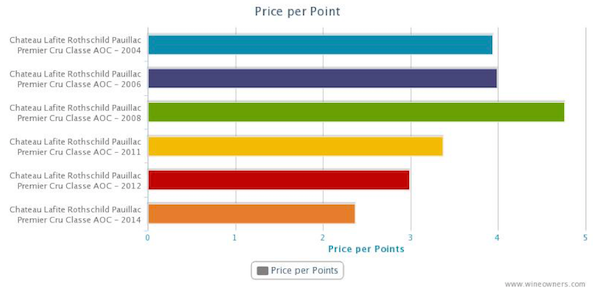

Lafite 2014

We didn’t think Lafite was the most immediately impressive First Growth in 2014. In fact it seemed to be the most obdurate. Yet the critics lapped it up, and we’re more than happy to defer to their better judgement. In the meantime one thing is very, very obvious looking at the price per points analysis. It’s priced as a come-on to consumers to open their pocket books and buy early.

SOMETHING BORROWED

Anything can be borrowed but it must be returned afterwards.

A couple of worrying features of the 2014 campaign have emerged.

The first is linkage. Back in 2010 Bordeaux chose to tie certain wines with others. The most interesting example was a pack of Rieussec linked to a pack of Carruades. Interesting because of the distorting factor it had on the market for Rieussec. Back then, merchants simply added a couple of hundred pounds to the price of their Carruades allocation before dumping Rieussec onto Livex and selling through at £210-£220 per 12; roughly half the retail release price offered to consumers. To this day those Livex members who jumped in and hoovered up stock are sitting on the best returns that the 2010 vintage had to offer. Not great for the consumer who bought Carruades but a creative market response to price manipulation.

Linkage is seemingly back, with Rieussec once again tied to Carruades, according to one or two merchants we talked to. Who’s doing the tying is a question to which I have no answer, and this time the merchants can’t just transfer pricing from one wine (relatively difficult to sell at first release) to another (for which there was unquenchable demand back in 2010).

The second feature is limited quantities released by some Châteaux. Who’d have thought the Bordelais would have de facto discouraged early purchases in 2014 – maybe they don’t believe in the en primeur system after all? Like a boyfriend who isn’t in love anymore, but is too insecure to let his partner go.

Calon-Ségur is a wine I thought showed delightfully in 2014. The vibe among négociants in Bordeaux was positive, lending emotional support to the wine even before release.

Recently acquired by Suravenir Assurance, an insurance company for whom no doubt a higher average release price per bottle will help to sûr-value their estate on a forward-looking basis, chose to release up but at a realistic price point for the fine quality. But then the real game plan became apparent. There was no wine: merchants who had assumed they were in line for a reasonable allocation (and had promised private clients allocations on that basis) found that they were empty handed. Merchants were left scurrying around for whatever they could pick up. Consumers were left feeling that however big Calon’s heart, maybe it was losing its soul.

This is the sort of attempt at market influence that Bordeaux EP does not need. Frankly, if Châteaux would prefer to achieve a higher price than the market can bear, then why not exit EP as Latour did, and release when the wine is considered ready? It’s dishonest to play it both ways and the market will not necessarily reward throttled supply with higher prices: demand is often chocked off too in the process.

SOMETHING BLUE

The symbol of faithfulness, purity and loyalty.

There are so many Châteaux that we could have used to exemplify the question of whether we would have chosen to buy early, or wait a few years until the young wines are fully formed, or go back to earlier vintages where there’s so much value to be had. In most (but by no means all) cases we’d go back to earlier vintages and wait to buy the new releases in bottle. But buying young wine isn’t an entirely rational decision as we all know.

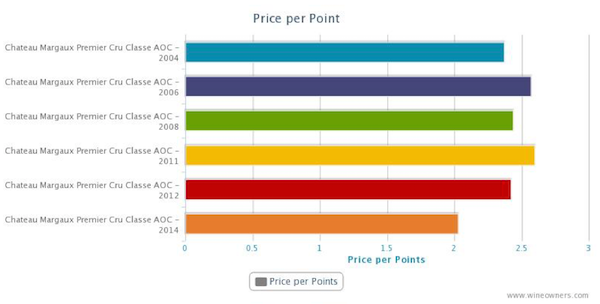

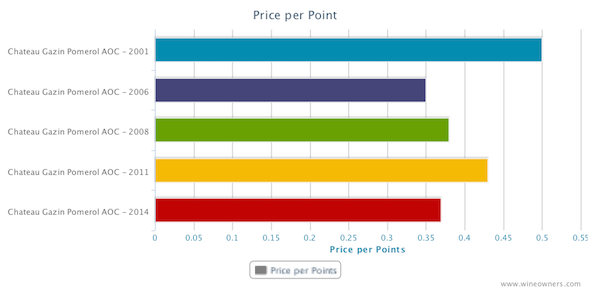

Which vintages would you buy on the basis of the following charts? You decide!

by Wine Owners

Posted on 2014-03-25

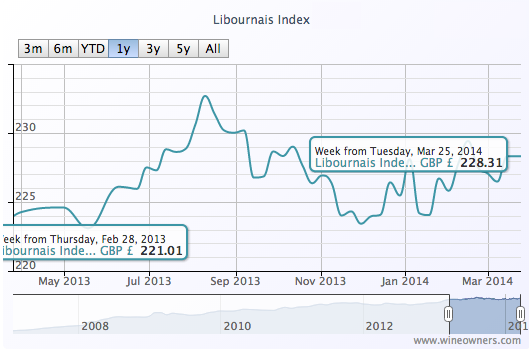

With a level of 221 at the end of February 2013 (baseline January 31st 2007), the Libournais Index shows a relatively flat performance, with a change of only 1.8% over a 1-year period to 228.31.

While the top movers of the Medoc Classed Growth Index were relatively affordable vintages, the Libournais Index top gainers feature higher value wines, as do the biggest fallers, perhaps indicating a rather higher level of market interest than on the left bank.

Individual high-scoring wines, however, buck the trend, with the 100 pointers La Violette 2010 and Petrus 2009 showing that a perfect Parker score can still be a market driver and suggesting that scarcity may increasingly be a market driver within the Bordeaux market, either due to tiny production or due to age.

It's arguably even more interesting to see the price of Vieux Chateau Certan 2010 fall quite significantly since the turn of the year (possibly as stockholders finally throw their hands up and start to write-down the value of their holdings?). Will Vieux Chateau Certan 2010 fall further carried by the momentum of price gravity? At some point this could be extremely tempting, for an utterly sublime wine that was considered by many (including us) to be perfect.

TOP GAINERS

BIGGEST FALLERS

Create an account on www.wineowners.com to receive our analyses by email.

by Wine Owners

Posted on 2013-11-15

The 2009 Annual Bordeaux Tasting organised by The Institute of the Masters of Wine recently highlighted the high standard and homogeneity of Bordeaux 2009.

The best Medocs were beautifully perfumed, notably throughout the Graves, Margaux, and St. Julien. Where freshness was retained, the very ripe fruit lifted by fresh acidity, the wines were both easy to taste and delineated.

Examples that stood out were:

Pontet Canet with a refined, liqueur texture, fabulous confit yet crystalline, vivid fruit, and a velvety finish.

Leoville Barton was extremely pretty for a property that typically makes very structured long-term wines, exciting and fresh with wonderful aromatics.

Montrose was immense, and so confidently poised within its powerful structure.

Mission Haut Brion was truly fine; beautifully perfumed, noble fruit, dusty tannins in no way inhibiting a very long finish.

Sister property Haut Brion showed in a more structured vein, bright fruits, yeast and cedar on the nose, uplifting with a real sense of energy underlying the progression of flavours. Haut Brion was a beacon of how great 2009 can be when ripe fruit, acidity, structure and energy come together to create a unique, visceral experience. It also served to highlight how unctuous and relatively soft so many of the other wines in 2009 really are. And this isn't necessarily a good thing for the long term.

At a recent dinner tutored by Edouard Moueix where he showed La Fleur Petrus 2009 and 2010 side by side, the 2009 was unctuous and richly textured. The 2010 had more clearly delineated elements, showed as being far more complex, with wave after wave of nuanced flavours through an almost interminable finish.

Back in 2011, in the heat-wave of that Bordeaux spring, 2010 also showed brilliantly. Where wines were compared side by side, the 2010 vintage got my vote almost every time, including beauties from:

Calon Segur

Cheval Blanc

Haut Brion

Haut-Bailly

La Conseillante

L’Eglise-Clinet

La Mission Haut-Brion

Latour

Le Pin

Margaux

Montrose

Pichon Longueville Comtesse de Lalande

Rauzan Segla

Vieux Chateau Certan

So for me whilst the two vintages are both extraordinary; I prefer the definition, balance, complexity and enduring length of flavour so commonly found in the best 2010 red Bordeaux, which gets my vintage vote bar a few exceptions like Leoville Barton.